Our Data

AUTOMOTIVE INDUSTRY IN HUNGARY 2012

Prepared by: G├Ībor Sz├╝cs

Vehicle manufacturing is the most significant sector of the Hungarian processing industry. This activity does not concentrate on the final product only but includes several other producing companies who take part in the process as suppliers. Thanks to the cost-effectiveness Hungarian vehicle industry is one of the most competitive in Europe.

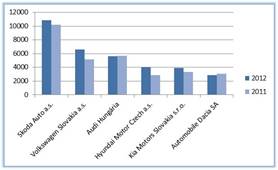

In the central European region Hungary clearly takes the 3rd place in the vehicle manufacturing sector on the basis of many respects. Nearly half of the turnover is provided by Czech vehicle manufacturer companies amongst them have to lay emphasis on Skoda Auto a.s. with its more than 10 million eur turnover in 2012, Volkswagen Slovakia is the second followed by Audi Hung├Īria with 5,6 million eur. ┬ĀThe total turnover of 15 billion eur of the Hungarian companies is only 2 billion less than the performance of Slovaks, this difference nominally almost equal to the 2011 values. The fourth place is taken by Romania where also growth was experienced compared to the previous year. It should be mentioned here that the fields of activities relating to the vehicle industry not necessarily cover the whole circle of suppliers because the main activity of those suppliers producing seat covers belongs to the textile industry rather than the vehicle industry. During the preparation of this analysis NACE 29 and 30 codes have been taken into consideration which clearly refer to the examined group of targets (Manufacture of motor vehicles and manufature of other transport equipment).

Vehicle manufacturer companies of the region with the largest opearting turnover. Data in million eur.

Source: c├®ginform├Īcio.hu Hungary

Source: c├®ginform├Īcio.hu Hungary

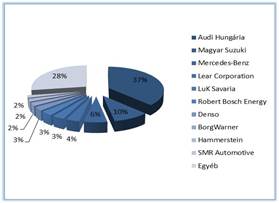

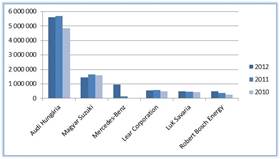

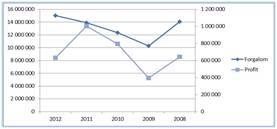

Significant expansion happened in the given market in Hungary owing to the investments of Mercedes factory effected in the previous years and the capacity enlargement of Audi in Gy┼ær. In 2012 the operating turnover of this sector exceeded 15 billion eur which is higher than it was before the crisis. 53% of this is provided by the 3 large international automobile manufacturer companies. Audi itself notes 37% of the whole market. Its net revenue realized in the current year practically was the same as in 2008, there was a 30% decline in 2009 but they managed to get back by 2011. The operating turnover of the Suzuki factory in Esztergom has continually fallen in the past five years, today the net revenue of the company is only 60% of the 2008 yearŌĆÖs. ┬ĀAt the general sector level this fall has been compensated by Mercedes factory which joined the market in 2010 with a 944 million operating turnover in the current year. In the Opel factory in Szentgotth├Īrd for today the short runned automible assembly has been replaced by long runned engine and gears production. Because of the profile change the net revenue declined to the fifth of 2006 yearŌĆÖs to 87 million eur but the constancy of human resources supports that this net revenue was probably led to another operation.

Market share of the largest vehicle manufacturer companies in Hungary on the basis of their operating turnover in 2012.

Source: c├®ginform├Īcio.hu Hungary

Source: c├®ginform├Īcio.hu Hungary

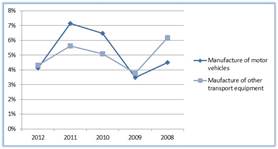

According to the above it is not suprising that the activity of manufacture of motor vehicles (NACE 29) presents 91% of the market within this the activity of manufacture of other parts and accessories for motor vehicles (NACE 2932) is the most dominant. We have to point out here that Audi Hung├Īria belongs to the latter while the other two companies with the same profile act under the main activity of manufacture of motor vehicles (NACE 2910). It is worth mentioning the sector of manufacture of electrical and electronic equipment for motor vehicles (NACE 2931) with its operating turnover of 1,64 billion eur, 77% of which is given by 3 companies: Lear Corporation Hungary; Robert Bosch Energy and Body Systems and Valeo Auto-Electric Magyarorsz├Īg. The last two companies produced a significant increase according to this ratio compared to the year 2011. Robert Bosch increased its opearting turnover with 110 million and Valeo with 41 million eur. The previous corresponds to 29%, the latter to 20% increase. Although the operating turnover of Audi decreased with 1,3%, the given sector has grown with 2,7% for example due to the 141 million operating turnover increase of Hammerstein Aut├│r├®szegys├®ggy├Īrt├│ Bt. Somehow the sector of manufature of other transport equipment is more balanced (NACE 30) which operating turnover (460 million eur) is the fraction of manufacture of motor vehicles however this level is 14% higer than in the previous year and by 20% than in 2008. Knorr Bremse provides the 40% of the market, completing with another 13 companies, they cover 90% of the sector in terms of net revenue. The largest decrease is recorded by Bombardier Trasportation, its 61 million net revenue in 2008 has fallen to 23 million eur by year 2012. ┬Ā

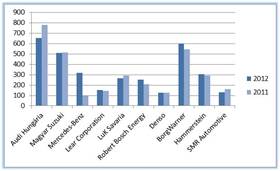

Operating turnover of the largest vehicle manufacturer companies in Hungary 2012-2010. Data in thousand eur.

Source: c├®ginform├Īcio.hu

Source: c├®ginform├Īcio.hu

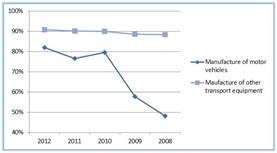

The export amounts to 89% of the operating turnover, this level was reached continuosly, starting from 86% in 2008. The market should be considered minimally more concentrated on the basis of this ratio, the three large cut 57% from the cake for themselves and completing with another 19 companies, they cover 90% of the whole market. Monitoring the changes we receive the same picture as at the examination of net revenue, Bosch and Hammerstein realized the biggest growth after Mercedes with 117 and 100 million eur. For today the sector outperforms the 2008 values with 10% (by examining the net revenue with 6,7%) owing to the growth of export ratio. At Suzuki this ratio has fallen back with 130 million compared to the previous year, so the experienced change in the export line amounts to half of the decrease of the operating turnover. All of this is interesting in the light of the fact that similarly to the sector this company also has nearly 90% of export share, so the domestic sale participated with higher rates in the decrease compared to the importance of its own. The sector of manufature of other transport equipment is less export oriented compared to the manufacture of motor vehicles although the rate is also high 74% here. At the same time it was only 43% in 2008 which is explained by the shifting of the largest companies towards export. For example while the operating turnover of Knorr Bremse has increased by one and a half times its export revenue has nearly tripled.

Export rate during the past five years.

Source: c├®ginform├Īcio.hu

Source: c├®ginform├Īcio.hu

By examining the past five years the P/L before tax describes a very different path. Companies reached 610 million eur P/L before tax on sectoral level in 2012, only 3 million eur more than in 2008. The year 2009 also resulted in a significant fall, profit was decreased by 33% but there was a rapid recovery in 2010 and the sector has surpassed the 2008 figures.

Tendency of operating turnover and P/L before tax 2012-2008. Data in thousand eur.

Source: c├®ginform├Īcio.hu

Source: c├®ginform├Īcio.hu

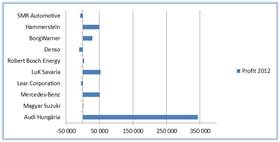

The growing did not stop in 2011, profit has increased by 28%, after which it significantly decreased by 39% for 2012. We get the answer straight away as we look into the financial reports of the companies: the 320 million eur profit decrease of Audi Hung├Īria is owing to the actualization of accounting price system, this has occured in the other expenses line and contributed to the fall in the sector by 387 million eur but also a decrease can be seen in the result line of Suzuki, Lear Corporation Hungary and Denso Hung├Īria. Mercedes realized profit, it had -26 million eur P/L before tax in 2011 but performed a 52 million positive result in 2012. The difference was significant for Hammerstein too, the P/L before tax of the current year was 38 million more than in the previous year. Despite the fall experienced in the last analysed year the sector remained stable profitable, the P/L before tax has moved in the positive range through the past five years. Generally it can be said the performance of Audi Hung├Īria is determining on the sectoral level. 50% of the realized profit is delivered by Audi despite the previously mentioned fall. 90% of the total profit is subscribed by 18 companies, Audi is followed by Luk Savaria, Mercedes and Hammersetein in the leading group. 435 out of the examined 700 companies performed a positive result with a total of 693 million eur. 262 companies got to the negative side with a total of 70 million eur minus. The most of this have been suffered by Denso Hung├Īria and Magna Automotive with 10-10 million eur, manufacturers of fuel supply systems from Sz├®kesfeh├®rv├Īr. The cumulated P/L before tax of the three motor vehicle manufaturer companies is 57% of the realized amount of the whole market which is 4 percentage points more as their market share performed in terms of operating turnover. It is not suprising the 97% of the profit is produced in the manufacture of motor vehicles sector (NACE 29) and the manufature of other transport equipment (NACE 30) is underperformed compared to its market share. Here the numbers of Knorr Bremse are determinant, it had 16 million eur profit in 2012 which is 64% of the profit realized by 134 companies. 109 companies got to the negative side, half of the 5,2 million eur loss was endured by Bombardier M├üV Transportation. The active firms in this industry have 32 million eur tax liabilities, this is 5% of the P/L before tax at sectoral level. The situation was slightly better in 2008 when after the same result the state budget had been enriched by 45 million eur. For the first time since 2003, the owners of Audi took the profit out and even the retained earnings has been debited by 2,6 billion eur, a total of 3 billion eur has been paid out as dividends.

P/L before tax of vehicle manufacturer companies with the largest operating turnover in Hungary in 2012. Values are in thousand eur.

Source: c├®ginform├Īcio.hu

Source: c├®ginform├Īcio.hu

Profitable ratios of the sector

From the profitable ratios we have examined the shareholders funds and return of assets besides the profit margin. The ratios have been calculated by correcting the exceptional items.

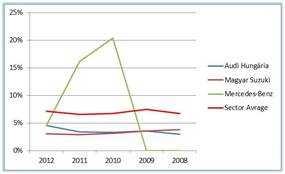

In terms of profit margin in 2011 the industry ratio has declined by 3 percentage points compared to year 2008. Here we have to mention again that, this was mainly resulted by an outstanding value in the other expenses line of Audi Hung├Īria rather than an overall industry decline. Apart from this it can be said about Audi that the profitability continues to grow, the 13,33% profit margin in 2011 was the highest amongst the leading companies. In 2012 however Opel in Szentgotth├Īrd became the best with the value of 22,56%, followed by Hammerstein with 16%. Both companies have made significant growth on the basis of the ratio (18,5 and 9 percentage points). ┬ĀSomehow the picture is more shaded in the manufature of other transport equipment (NACE 30) sector, the numbers of Audi do not appear here, still it has reached the lowest profit margin after 2009. The 8,55% ratio of the sectorally dominant Knorr Bremse has fallen by 1 percentage point compared to 2011 year but the largest decrease was endured by Bombardier Transportation from 7,3% to -11,4.

Tendency of profit margin in the examined sectors 2012-2008.

Source: c├®ginform├Īcio.hu

Source: c├®ginform├Īcio.hu

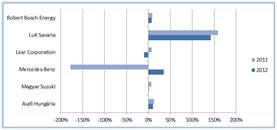

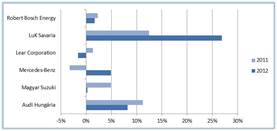

It seems the return on equity (ROE) of vehicle industry is balanced. This ratio reached 11,5% in 2012 which was 1,3 percentage points less than in 2011 but higher than in 2008. The best at this ratio was Luk Savaria Kuplunggy├Īrt├│ with a 142% result and the growth of Mercedes is outstandig compared to the values of 2011┬Ā┬Ā ( became 34,7% from -177,6% ).┬Ā The diagram of manufacture of motor vehicles (NACE 30) sector has come forward with a ratio that was even weaker compared to the 2009 data. All this is of course a question of comparison since we are talking about a 16,3% ratio. In this case the overall picture is depreciated by the ratios of two companies Bomabardier Transportation and ACCEL Hunland Ker├®kp├Īrgy├Īrt├│ Kft. already mentioned in connection with the profit margin. The ROE was -23% at the former in 2012, at the latter 20 percentage points lower value can be observed in comparison to 2009.

Return on equity (ROE) of the vehicle manufacturer companies with the largest operating turnover in Hungary 2012-2011. (Corrigated with extraordinary result)

Source: c├®ginform├Īcio.hu

Source: c├®ginform├Īcio.hu

By the examination of the return on assets (ROA) we receive a slightly different picture. The 6% ratio of the sector is slightly lower than the 2008 value but here we have to take into consideration the over-weighting of Audi. SuzukiŌĆÖs ratio converges to zero, while the other companies show a rather diversified picture. The leading group is similar to the hierarchy made on the basis of return on equity (ROE), but here Hammerstein comes before Luk Savaria. It is interesting at the latter that its assets were reduced by half in 2012. On the basis of this ratio the manufacture of motor vehicles (29) sector proved to be more effective than the manufature of other transport equipment (30) the 4,45% result of which was underperformed by the 2009 data

Return on assets (ROA) of the vehicle manaufacturer companies with the largest operating turnover in Hungary 2012-2011. (Corrigated with extraordinary result)

Source: c├®ginform├Īcio.hu

Source: c├®ginform├Īcio.hu

Staff and profitable ratios

Year after year more people work in the domestic vehicle industry which confirms that foreign companies see great potential in the exploitation of skilled domestic labour. Due to the low wages the obtainable high profitability makes this industry attractive for the investors.

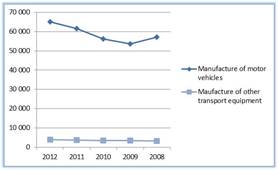

Regarding the number of employees, we can often hear about headcounts beyond one hundred thousand persons when the Hungarian vehicle manufacturing is mentioned. However we have to take into consideration that the field of activity of several suppliers do not belong to the vehicle manufacturing for example the tyre manufacturers or companies producing seat covers. Companies belonging to the examined field of activities (29,30) employed 67 295 workers in 2012 which is 3227 more than a year ago. The growth can be considered constant since 2009, after a 5% fall the industry pushed off from here and the number of employees has increased by 21% during 3 years. Audi Hung├Īria and Mercedes really took a big step forward. At the former the average number of employees were 8571 in 2012 this means a 15% increase compared to the last year and 44% increase compared to 2008. Lear Corporation is the second largest employer with 3600 employees where continuous decrease can be observed. Similar cutback has been executed also by Denso Gy├Īrt├│ Magyarorsz├Īg Kft here the number of employees is less by 850 than 5 years ago. The workforce of Suzuki also decreased further, the current 2844 employees represent only half of the staff it was in 2008. The background of the increase is provided by the already mentioned Audi and Mercedes, the latter has become the fourth biggest employers in the sector by its 2965 employees.┬Ā There was an increase also at Luk Savaria and Bosch Energy and Body Systems, the number of employees of 1839 and 1906 nearly the double of 2008 data. 14 companies employ at least 1000 employees which means 50% of the whole market.

Tendency of the number of employees in the vehicle industry in the past 5 years.

Source: c├®ginform├Īcio.hu

Source: c├®ginform├Īcio.hu

The operating turnover per employee is permanently growing although the 2008 level has not been reached yet. Here the vehicle manufacture sector was more effective, the value of 228 000 eur is the double of the amount experienced in the manufature of other transport equipment section. All of this is due to the vehicle manufacture companies, within this Audi Hung├Īria performed the highest value, 656 000 eur operating turnover per employee. Although it should be noted here by examining the past five years that this ratio is at the low point at Audi, it is less by 300 000 from the data examined in 2008. In turn there is an improvement at Suzuki due to the staff reductions, they managed to move forward by 20% compared to their state five years earlier. Another two companies, BorgWarner and W.E.T. Automotive were able to produce values above 500 000 eur, for the latter this means more than 70% improvement compared to 2008. By examining the largest companies a positive trend can be observed, as on the basis of operating turnover 15 companies out of the first 25 showed higher value of the ratio in 2012 than in 2008.

Operating turnover per person at the largest vehicle manufacturer companies in Hungary 2012-2011. Data in thousand eur.

Source: c├®ginform├Īcio.hu

Source: c├®ginform├Īcio.hu

The costs of employees per peson was 16 thousand eur in 2012, there was not any significant move in either direction from this level during the examined period. When comparing the two sectors we almost get the same values. The situation is quite different if we look into the financial reports of the companies, because at Audi the costs of employees per person is nearly the double than the average of the sector while Mercedes is underneath by 1000 eur. Suzuki brings the average, the Opel from Szentgotth├Īrd is only 4 thousand eur behind the leader. This ratio was above 20 thousand eur at Knorr Bremse (25), at W.E.T. Automotive (27), at Zf Hung├Īria (22) and at BorgWarner (23). It can be observed that the lowest ratios are experienced at companies having residence at Eastern Hungary and at the same time the profit per employee is also the lowest here. On the basis of the latter ratio Hammerstein and BorgWarner performed outsanding values, the P/L before tax per person was 49 and 48 thousand eur. Audi is at the third place with 40 thousand eur despite the significant fall which happened on the profit line.┬Ā In the previous two years it dominated in this field with 104 and 100 thousand eur values.

We cannot experience large fluctuation if we look at the costs of employees in % of the operating turnover. Although the ratio of 7,12% is the higest after 2009, however the lowest ratio from 2011 is only 0,57 percentage points higher than in 2012. On the basis of this ratio there is a significant difference between the two sectors, the performed 13,61% in the manufature of other transport equipment sector is almost double of that is experienced in the manufacture of motor vehicles sector. So companies operating in the latter sector perform a unit of operating turnover on the average expending half of the costs of employees. All of this is owing to the outstanding efficiency of the three motor vehicle manufacture companies, from which the 3% ratio of Suzuki is remarkable because this is the lowest value at sectoral level. BorgWarner and Hammerstein were also able to show ratios under 5% (3,76 and 4,39). For comparison the Czech Skoda Auto a.s. and the Romanian Automobile Dacia SA also have 7% ratio.

Costs of employees expressed in percentage of the operating turnover. Values are in thousand eur.

Source: c├®ginform├Īcio.hu

Source: c├®ginform├Īcio.hu

It is proved by the numbers that the vehicle manufacture sector is indeed in growing stage in our country. At the same time the background of this was mainly given by the presence of Mercedes factory and the expansion of Audi. The profitable ratios confirm, that the running-in of this sector is not accidental in Hungary because on the basis of operating turnover per employee and profit per employee it can compete with western competitors, however due to the low cost of labour the same result can be performed by less effort. If it is possible to maintain this status or maybe improve the competitiveness even further then Hungary may become the regional headquarter of Cental European vehicle manufacturing.

┬Ā

English

English