Our Data

Construction industry in Hungary 2015

Prepared by: Gábor Szücs

Net revenue of building industrial sector has continued to grow, besides it is joyful that practically all geographical regions equally did their share from the growth. In this analysis we tried to compare the performance of particular building industrial sectors according to net revenue, profit, export and profitability.

If we strictly rely on descriptions of field of activities, construction of buildings (41), civil engineering (42) and specialised construction activities (43) can be connected to building industry. According to these companies would not belong to the mass – which are closely related to building industry – such as concrete and cement manufacturers or companies acting as manufacturers of structural metal products like KĂ–ZGÉP ÉpĂtĹ‘ Ă©s FĂ©mszerkezetgyártĂł Zrt. During the preparation of the analysis all companies have been taken into consideration which have reference to building industry or any related activity among their main activities. We mainly examine the sector, therefore only the non-consolidated reports have been taken into account, so we tried to avoid that data of companies being active in other sectors disfigure the results. Under operating turnover we mean net sales revenues and other revenues. This is necessary because the content of financial report lines may vary from country to country so we tried to use a standard format.

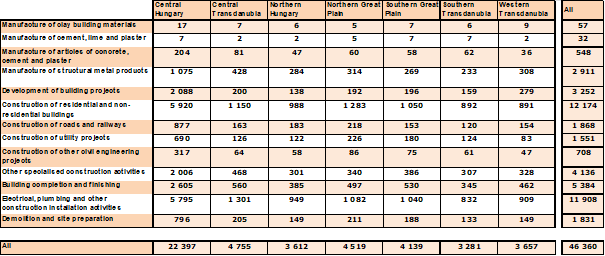

Number of operating companies in building industrial sector was slightly less than 50 thousand in the current year, at most of them, a total of 12 174 firms, construction of residental and non-residental buildings appears as their main activity. Companies are active here such as Strabag MML or Market ÉpĂtĹ‘ Zrt.  Former belongs to the interest of Strabag SE from Austria, the latter is fully Hungarian-owned. The number of companies was outstanding in electrical, plumbing and other construction installation activities sector, a total of 11 908 firms, we say it in the light of that this number does not reach six thousand at none of the examined sectors. According to territories Central Hungarian region is the leader, where the number of registered economical companies was 22 397, it is followed by Central Transdanubian and Northern Great Plain region. Lag is considerable here because based on this almost half of the building industrial companies are linked to one region.

Number of companies operating in building industrial sectors in certain Hungarian regions.

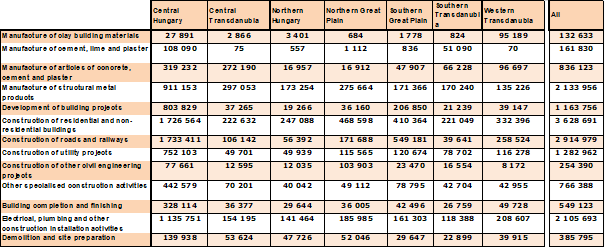

In 2015 net revenue of the sector was 16,3 billion eur, which is 1,7 billion eur more than a year before. Central Hungarian region was the pulling power, which provided more than the half of the increase, a total of 900 million eur, but as we mentioned earlier, all regions took their part from the growth. If we examine the leader companies, only the 34 billion of KözgĂ©p, 62 billion of Swietelsky and 48 billion eur decrease of A-hĂd cathes our eyes, which was compensated by the increase of other top 10 companies, so the growth of the sector did not resulted in further increase of concentration. Reasons of increase should be searched downwards at companies with lower net revenue, what considering the sector as a whole can be a positive process. Strabag MLM slightly climbed back, because there was 70 billion eur decrease at this company by 2014, however net revenue data was better by 33 billion by 2015. In terms of growth MVM Ovit is the leader, its net revenue was 51 billion eur more than a year before. In region/sector context the most net revenue has been realized by Central Hungarian construction of residental & non-residental buildings and road & railway construction sectors, one by one more than 1,7 billion eur. At national level besides the previously mentioned two sectors, the manufacture of structural metal products and electrical, plumbing & other construction installation activities sectors stepped over the two billion euro limit.

Operating turnover of building industrial sectors in certain Hungarian regions in 2015. Data in thousand EUR.

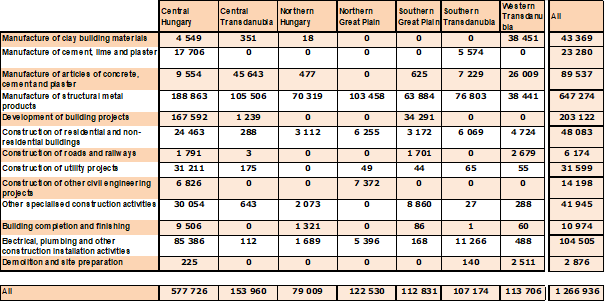

The definition of export net revenue in case of this industrial sector is a little bit different than in the field of manufacture or trade, it mainly covered by revenues from commissions where the work was done abroad. A slight increase can be experienced at this data line, export net revenue in the current year was 81 million eur more than a year before, which represents a 6,8% growth. Northern Great Plain region was the driving force of this, where nearly 24% increase was experienced. Southern Transdanubia is not much behind, where 19 million eur export increase meant 22% moving. In terms of regions, just like last year Central Hungarian region was the first, among the sectors manufacture of structural metal products has more than 50% of market performance, a total of 647 million eur.

Export net revenue of building industrial sectors in certain Hungarian regions in 2015. Data in thousand EUR.

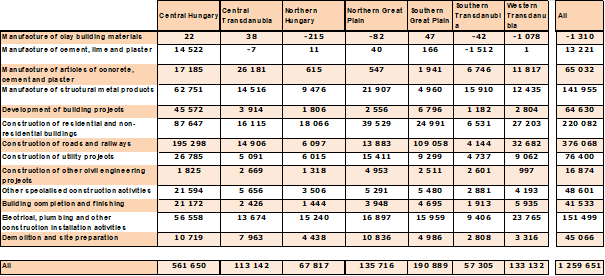

P/L before tax also has grown, which exceeded one billion eur for the current year, exactly 1,26 billion eur have been realized by companies operating in this sector, which is 360 million more than the performance of the previous year. None of the regions suffered losses in 2015, from the sectors only manufacture of clay building materials sector ended with a deficit. The largest profit was generated in Central Hungarian region, a total of 577 million eur, road and railway construction sector contributed to this in largest measure with a total of 195 million eur. The overall growth of the sector is mainly due to this region, P/L before tax increased here nearly by 200 million eur during a year. Numbers of Közgép somewhat fell back, its profit decreased by 11 million eur, despite this still holds the leading position in the given ratio. In case of the competitors almost in all cases we can report about improvements, which resulted in the already mentioned growth. Profit increase is not a speciality of this region, we examined growth in all examined geographical units. In proportion the performance of Southern Great Plain region is outstanding, P/L before tax increased here by 68%, with 74 million eur during a year. At national level the 376 million eur performance of road and railway construction sector is outstanding, which exceeded the value of the year 2014 by 163 million eur.

P/L before tax of building industrial sectors in certain Hungarian regions in 2015.  Data in thousand EUR.

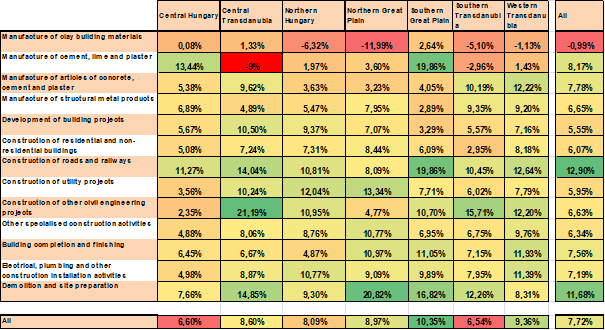

On the basis of profit margin describing profitability (P/L before tax as a proportion of sales revenue) similarly to last year Central Hungarian region is found at the end of the line this year, otherwise regarding volumes this region is standing in front everywhere. At the same time some improvement can be observed compared to 4,95% in the year 2014, this year profitability already was 6,6%. At national level this value increased by one and a half percentage point, so performing 7,7%. Among the regions the best result was performed by Southern Great Plain region by 10,35%, dethroning Northern Great Plain region which was the first one last year. There are two outstanding profitability among the sectors, road & railway construction sector and demolition & site preparation sector, the former performed 12,9 the latter 11,7% P/L before tax as a proportion of sales revenue. The lowest profitability was in manufacture of clay building materials sector, the lowest value also got out from here according to sector/territory, it was -11,9% in Northern Great Plain region.  However it should be noted, this data is based on only a few companies, a total of 4 firms and among them the 78 million eur loss of the largest in the current year, Kunsági Téglaipari Kft caused this negative value.

Pre-tax profit margin of building industrial sectors in certain Hungarian regions in 2015.

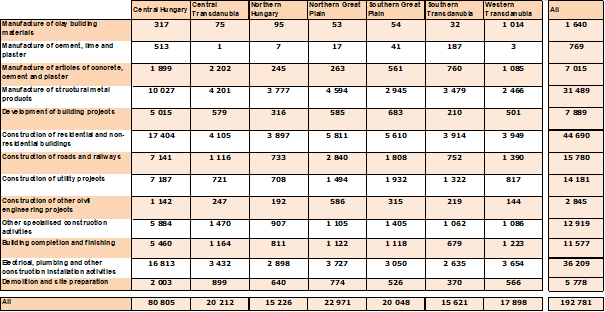

The number of people employed in this sector increased further, 192 thousand people worked in building industrial sectors in the current year, which is 4 thousand more than a year before. This increase practically has been performed by Central Hungarian region, where the number of employees increased from 76 thousand to 80 thousand. Regarding the sectors construction of residental and non-residental buildings became the first by employing 44 690 persons in 2015. 36 thousand persons were employed by electrical, plumbing and other construction installation activities sector, it is follwed by manufacture of structural metal products sector with 31 489 employees. The largest employer is MVM OVIT by 1650 persons, this is 10 people more than a year before, it is followed by Siemens Termelő, Szolgáltató és Kereskedelmi Zrt. by 1379 persons.

Number of employees of building industrial sectors in certain Hungarian regions in 2015.

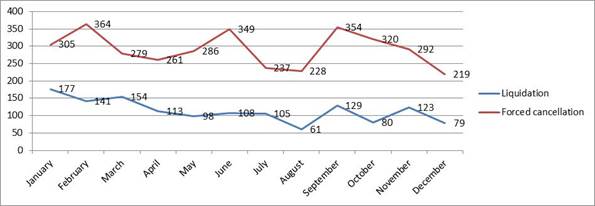

Among negative events we took liquidation and forced cancellation procedures under investigation which were started in 2015. Number of the latter was slightly more than a year ago, exactly by 111. Actually we can observe 3 waves, which culminated in February, June and October then by the end of the year their number steadily declined. There were no such trends in case of liquidation processes, the higher number of procedures at the beginning of the year progressively decreased until August then it began to increase again to the previous levels. Probably court vacation and lower summer activity also played a role in this.

English

English