Our Data

Construction industry in Hungary 2014

Prepared by: G├Ībor Sz├╝cs

Building industrial production has significantly increased in Hungary compared to the year 2013. Increase is primarily driven by construction of buildings for health and education purposes and development of transport infrastructure. In this analysis we tried to compare the performance of particular building industrial sectors according to net revenue, profit, export and profitability.

If we strictly rely on descriptions of fields of activities, construction of buildings (41), civil engineering (42) and specialised construction activities (43) can be connected to building industry. According to these companies would not belong to the mass ŌĆō which are closely related to building industry ŌĆō such as concrete and cement manufacturers or companies acting as manufacturers of structural metal products like K├¢ZG├ēP ├ēp├Łt┼æ ├®s F├®mszerkezetgy├Īrt├│ Zrt. During the preparation of the analysis all companies have been taken into consideration which have reference to building industry or any related activity among their main activities. We mainly examine the sector, therefore only the non-consolidated reports have been taken into account, so we tried to avoid that data of companies being active in other sectors disfigure the results. Under operating turnover we mean net sales revenues and other revenues. This is necessary because the content of the financial report lines may vary from country to country so we tried to use a standard format.

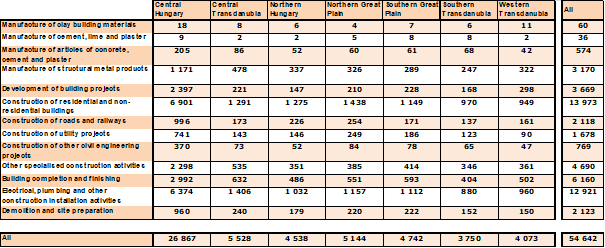

Number of operating companies in building industrial sector was slightly less than 55 thousand in the current year, at most of them, a total of 13 973 firms, construction of residental and non-residental buildings appears as their main activity. ┬ĀCompanies are active here such as Strabag MML or Market ├ēp├Łt┼æ Zrt. Former belongs to the interest of the Strabag SE from Austria, the latter is fully Hungarian-owned. The number of companies was outstanding in electrical, plumbing and other construction installation activities sector, a total of 12 921 firms, we say it in the light of that this number does not reach seven thousand at none of the examined sectors. According to territories Central Hungarian region is the leader, where the number of registered economical companies was 26 867, it is followed by Central Transdanubian and Northern Great Plain region. Lag is considerable here because based on this almost half of the building industrial companies are linked to one region.

Number of companies operating in building industrial sectors in certain Hungarian regions.

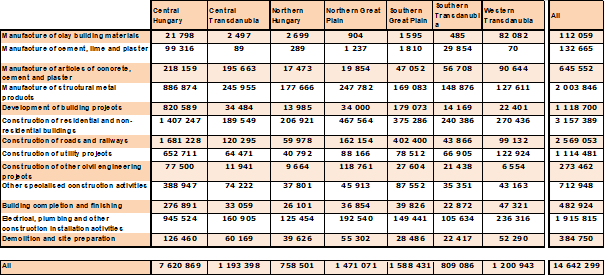

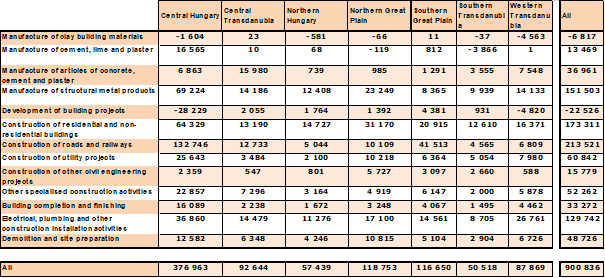

Net revenue of economical companies operating in this sector was 14,6 billion eur, only 150 million eur more than a year before. Similarly to the number of companies, net revenue can be linked to Central Hungarian region, a total of 7,6 billion eur. However, this represents a slight decline compared with 8,1 billion from a year ago, significant part of the difference was channeled to Great Plain region. The reason of this is not the decrease of net revenue of the leaders of the sector, both K├Čzg├®p as well as Strabag ├ültal├Īnos ├ēp├Łt┼æ Kft. were able to increase their net revenue, it is rather owed to the Hungarian branch establishment of Porr Bau Gmbh, which includes the numbers of the parent company in its financial reports and accounts for 2014 have not been published yet, therefore it duble deforms the observation. Among the ten companies with the largest net revenue, only the net revenue of Strabag MML has decreased significantly, from 219 million to 149 million eur. Besides the already mentioned two Great Plain regions we can experience typically stagnation or slight increase at the examined fields. If we should emphasize a particular region and a scope of activity, it could be Central Hungarian road and railway construction sector, where companies had the highest net revenue, it was nearly 1,7 billion eur. According to sectors, not this but the construction of residental and non-residental buildings is the national leader with total net revenue of 3,2 billion. This is due to the fact apart from Central Hungarian region, this sector has performed respectively higer net revenue in the other regions than road and railway construction sector. The level of two billion eur has already been performed by manufacture of structural metal products sector and electrical, plumbing and other construction installation activities sector was only a little bit behind.

Operating turnover of building industrial sectors in certain Hungarian regions in 2014. Data in thousand EUR.

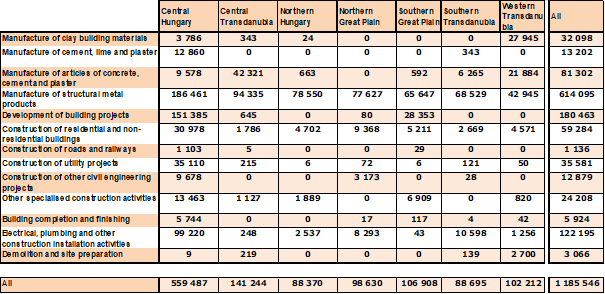

The definition of export net revenue in case of this industrial sector is a little bit different than in the field of manufacture or trade, it mainly covered by revenues from commissions where the work was done abroad. The examined result line was practically the same in the years 2013 and 2014, in both cases we get rounded 1,19 billion eur. In terms of regions not surprisingly also Central Hungarian region was the first here, among the sectors manufacture of structural metal products has more than 50% of market performance, a total of 606 million eur. This amount is divided between relatively lots of companies, we cannot speak about high concentration. Two companies performed export net revenue above 40 million eur, Caterpillar Magyarorsz├Īg and Kienle + Spiess Hungary, by 42 million and 40 million eur.

Export net revenue of building industrial sectors in certain Hungarian regions in 2014. Data in thousand EUR.

The picture is more favourable in terms of P/L before tax than a year ago, 900 million eur┬Ā value is 27% higher than data of previous year, which is mainly due to the positive change occurred in the ratios of companies operating in Southern Great Plain and Central Hungarian regions. In case of the former the improvement is very significant, it was around 120 million eur, which is even more important to emphasize because this regional ratio was negative last year. At the examination of companies the 58,8 million eur loss of Lafarge Cement in 2013 is striking, what they managed to bring up near zero levels in 2014. In general at the rest of the firms it can be said there were not more serious movements, however the insignificant minuses are turned to gentle increase for now in most cases. Good example for this 27 firms from 30 companies showing the most deficit in the given region are managed to improve their results at a certain result line by 2014. Among the sectors road and railway construction became the first by 216 million eur P/L before tax, construction of residental and non-residental buildings sector and manufacture of structural metal products sector got to the imaginary stand, the former performed 173 million, the latter 151 million eur profit. Development of building projects and manufacture of clay building materials sectors have suffered losses, at the same time the two together does not access minus 30 million eur. One company takes a significant part of it, GTC Magyarorsz├Īg Ingatlanfejleszt┼æ Zrt. has 49 million eur loss in the current year which is far below the industry average.

P/L before tax of building industrial sectors in certain Hungarian regions in 2014. Data in thousand EUR.

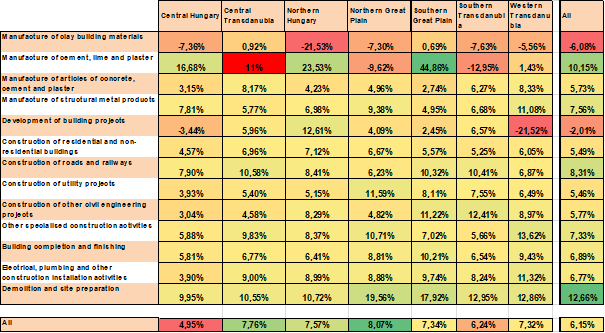

Profit margin describing profitability (P/L before tax as a proportion of sales revenue) this ratio was the lowest in 2014, 4,95 % in Central Hungarian region which was mentioned at the first place so far. The picture is more balanced at the other parts of Hungary, the value moves around 7-8%, only South Transdanubian region hangs out of the line a little bit by 6,24% . The value of the examined ratio was the higest in case of demolition and site preparation among the sectors, which was 12,66% at national level in the current year. There is another sector manufacture of clay building materials with marginal market share at the negative side by -6,08% .

Pre-tax profit margin of building industrial sectors in certain Hungarian regions in 2014.

188 thousand people have been employed by the examined nearly 55 thousand economical companies in 2014, which is 10 thousand more than a year before. 76 thousand people worked at Central Hungarian companies, 23 thousand in Northern Great Plain and 20 thousand people in Central Transdanubia. Among the sectors construction of residental and non-residental buildings is the largest employer with 42 thousand persons, then not road and railway construction sector is the next, but it is followed by electrical, plumbing and other construction installation activities sector by 35 500 employees. 30 thousand employees are employed in manufacture of structural metal products sector and it is followed by with the already mentioned road and railway construction sector with 15 thousand employees. According to this the most employees are employed by electrical, plumbing and other construction installation activities sector in Central Hungary, a total of 16 389 persons. The largest employer here is Johnson Controls Kft, where the number of employees has increased by 500 persons during a year, so the workforce became 1522 persons in 2014. Bilfinger IT Hungary Kft. employs nearly thousand persons, it has altogether 948 employees, at the following company the number of employees does not even reach a quarter of it. The largest employer of the building industry is MVM OVIT by 1640 employees, it is followed by Siemens Termel┼æ, Szolg├Īltat├│ ├®s Kereskedelmi Zrt. by 1405 persons. In both cases these numbers gently increased during a year.

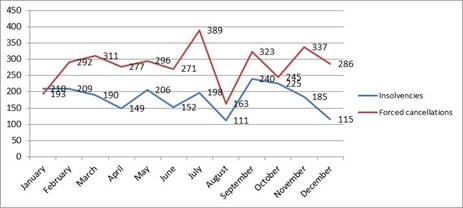

Among negative events we took liquidation and forced cancellation procedures which were started in 2014 under investigation. Majority of companies disappear because of the latter in Hungary, nearly 31 thousand companies have been banished from the market in 2014, it was 15 thousand more than a year ago. This number was 3383 in building industry which is not outstanding based on the number of firms operating in this sector. The greatest number of forced cancellation events have been registered in July, this number is almost reached 400. Not suprisingly manner August was the most peaceful month, when summer holidays also had an impact here. Diagram of starting liquidation procedures was similar, August was also the nadir here, but the culmination was in September by 240 launched procedures. According to territories Central Hungarian region hosting most of the companies was the leader by 908 liquidation and 1871 forced cancellation procedures. It is interesting, only in this region the number of forced cancellation procedures is quite overrepresented, it is more than double of liquidations. This is more balanced in the other regions, the two numbers are nearly the same in many cases. ┬Ā┬Ā┬Ā

English

English