Our Data

Construction industry in Hungary 2012

Prepared by: G├Ībor Sz├╝cs

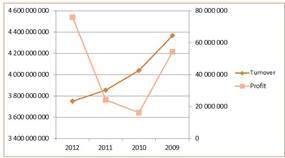

The operating turnover of Hungarian construction industrial companies has further reduced in 2012. Simultaneously the rise of sectoral profit should give occasion for hope, which is still far from the level before the crisis, survival of tendency could mean the beginning of a trend change. Despite the high number of companies working in this sector the significant part of the operating turnover is concentrated at a smaller group.

If we strictly rely on descriptions of areas of activities, construction of constructions (41), civil engineering (42) and specialized construction activities (43) can be connected to construction industry. According to these companies would not belong to the mass ŌĆō which closely related to construction industry ŌĆō such as concrete and cement manufacturers or companies acting as manufacturers of structural metal products like K├¢ZG├ēP ├ēp├Łt┼æ ├®s F├®mszerkezetgy├Īrt├│ Zrt which became market leader in 2012. During the preparation of the analysis all companies have been taken into consideration which have reference to construction industry or any related activity among their main activities. We mainly examine the sector, therefore only the non-consolidated reports have been taken into account, so we tried to avoid that data of companies being active in other sectors disfigure the results. Under operating turnover we mean net sales revenues and other revenues. This is necessary because the content of the report lines may vary from country to country so we tried to use a standard format.

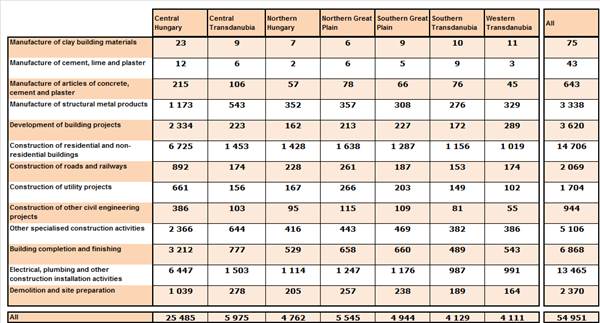

In 2012 there were 54 951 active companies operating in this sector, most of them (14 706 firms) are found in the construction of residential and non-residential constructions (NACE 412) sector. Electrical, plumbing and other construction installation activities are also significant, here 13 465 companies were found. In regional level Central-Hungary stands out in point of registered companies, because almost half of them (25 485) are located here.

Number of companies operating in construction industrial sectors in certain Hungarian regions.

Source: c├®ginform├Īcio.hu Kft.

Decrease of sectoral operating turnover has not stopped in 2012 either, 3 753 billion HUF operating turnover of the current year is 2,6% lower than in the previous year and 7,1% below the 2010 figures. Nearly 2 000 billion HUF were realized in Central-Hungarian region, which is not surprising because the residences of 8 companies with the largest operating turnover are located in this region. ┬Ā

Operating turnover of the

largest Hungarian construction industrial companies and change of sectoral

operating turnover and P/L before tax. Data in thousand HUF. ┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā ┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā

Operating turnover of the

largest Hungarian construction industrial companies and change of sectoral

operating turnover and P/L before tax. Data in thousand HUF. ┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā ┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā  ┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā

┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā

┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā┬Ā Source: c├®ginform├Īcio.hu Kft.

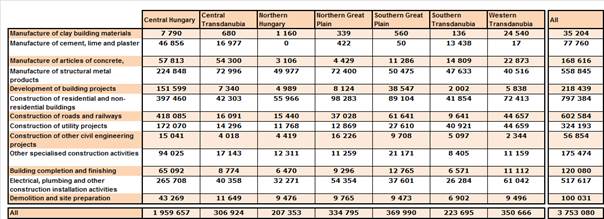

The leader K├Čzg├®p ├ēp├Łt┼æ- ├®s F├®mszerkezetgy├Īrt├│ Zrt. had 62 billion HUF operating turnover in 2012 which is 4,6 billion more than in the previous year and more than the triple of the values of year 2008. Net revenue of Strabag MML Kft significantly decreased in the examined period, because previously it twice managed to perform operating turnover over 80 billion HUF (in 2010 and 2008), but 51,7 billion HUF operating turnover of the current year is the lowest in the past 5 years. MVM OVIT, Strabag ├ültal├Īnos ├ēp├Łt┼æ Kft. and Swietelsky Magyarorsz├Īg Kft. are also found among the first five companies. 10% of the sectoral operating turnover is subscribed by 10 companies with the largest operating turnover, and approximately ┬╝ (one quarter) of it is subscribed by the 50 largest companies. From the certain sub-sectors the construction of residential and non-residential constructions sector performed the highest operating turnover 797 billion HUF, which was 87 billion HUF less than in 2011. Activities of construction of roads and railways (with 602 billion HUF) and manufacture of structural metal products (251) are finished in the first three. For the latter 11% of the market is given by the sectoral leader K├Čzg├®p, which has a great role in that the sub-sector unlike almost all the other areas of construction industry was continuously able to increase its operating turnover. In comparison construction of roads and railways sector has declined by nearly 400 billion HUF during 4 years, the construction of residential and non-residential constructions sector declined by 173 billion HUF. At regional level in slightly surprising manner the most significant fall of the sectoral operating turnover was experienced in Central Hungary compared to 2009, which nominally amounted to 600 billion HUF. ┬Ā

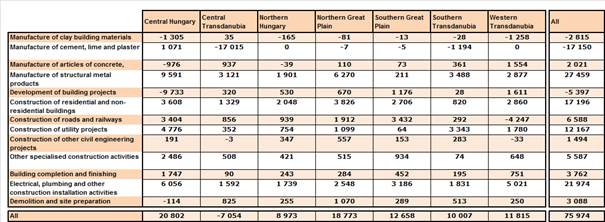

Operating turnover of construction industrial sectors in certain Hungarian regions in 2012. Data in million HUF.

Source: c├®ginform├Īcio.hu Kft.

We have not seen such amplitude in the other regions, expansions and reductions are practically compensate each other. 83% of the sectoral operating turnover is presented by companies employing more than 5 employees, while just over 10% of companies can be found in this segment. Further on 40% of the operating turnover was realized by companies employing more than 50 employees, 25% was realized by those which employed more than 150 employees, while the number of companies is 427 and 92 (of course the group of employers employing at least 150 persons also belong to the set employing at least 50 persons).

The export orientation of the sector cannot be said to be high, 313 billion HUF export net revenue in 2012 was only 8% of the operating turnover, at the same time the ratio is continuously growing. Within the traditional construction industrial activity export has a specific definition, because here work of a domestic company done abroad counts as export instead of selling variety of goods. More than half of the sectoral export is provided by manufacture of structural metal products sector, altogether 174,5 billion HUF which significantly raised from 2010 to 2011, when the ratio increased by 47 billion HUF during a year. The dominance of the Central-Hungarian region is slightly lower compared to the operating turnover, contrary to the 50% market share, here it has only 40% which means 6,1% export share. Compared to this, the ratio is 15% in Middle-Transdanubia due to 46 billion HUF export of companies operating in this region. Caterpillar Magyarorsz├Īg, Kienle+Speiss and Johnsons Controls have over 12 billion HUF export net revenue, the first two operates in manufacture of structural metal products sector and another 4 companies can be found here from the top ten. Among companies which are included in construction industry according to NACE codes (these are 41, 42 and 43 codes) only the already mentioned Johnsons Controls, Chemimozatz ├ēp├Łt┼æ ├®s Szerel┼æ Kft. and Bilfinger IT Hungary Kft are found in the leading group. ┬Ā

Increase can be experienced at the P/L before tax line, 17 billion HUF which was realized by 10 companies with the largest operating turnover also contributed to this. Seven of them

performed higher results than a year ago. 76 billion HUF P/L before tax which was performed at sectoral level is 52 billion HUF higher than in the previous year, which is mostly due to companies in Western Transdanubia and Central Hungary who jointly improved their result by 40 billion HUF. Central Hungarian companies are not so dominant here because just over 25% of sectoral profit is provided by them, in terms of operating turnover it has 50% market share. Divided by sectors the 27 billion HUF performed by manufacture of structural metal products sector is the highest value. It is followed by electrical, plumbing and other construction installation activities by 21 billion HUF and construction of residential and non-residential constructions by 17 billion HUF.

Altogether 3 sectors had to suffer losses in year 2012, among them manufacture of cement, lime and plaster sector performed mostly below average. By the examination of companies operating in this sector we receive the answer quickly why the sector has shown deficit in the past 2 years.

P/L before tax of construction industrial sectors in certain Hungarian regions in 2012. ┬Ā┬Ā┬ĀData in million HUF.

Source: c├®ginform├Īcio.hu Kft.

The negative P/L before tax of 17 billion HUF in 2012 and 22 billion HUF in 2011 practically correspond to the losses of Holcim Hung├Īria Cementipari Zrt in L├Ībatlan and its associated companies. It is interesting to experience a very low number of employees among companies performing the highest P/L before tax which can be said as sector specific. Positive P/L before tax was performed by 22 200 companies which amounts to 234 billion HUF. Approximately 12 000 companies had 0 HUF in this balance sheet line, the other companies ended with deficit.

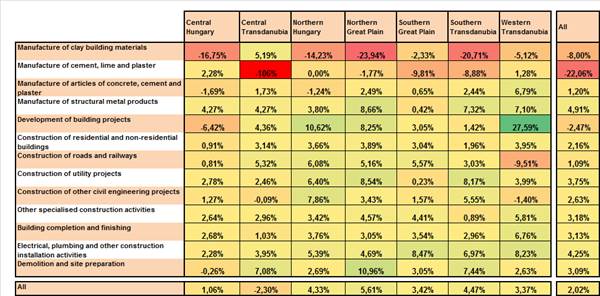

At sectoral level the profit margin was 2,02% in 2012. Apart from the loss making Middle- Transdanubia region, Central Hungary is the rearguard by its 1,06% ratio. In consideration of the market share of the region, the profitable ratio measured here has a significant impact on the efficiency of the sector. The other regions have performed between 3,4 and 5,6% , North Plain can take pride in the latter value due to 1,39 billion HUF P/L before tax of Sematic Hung├Īria Felvon├│gy├Īrt├│ Kft or 1,04 billion HUF P/L before tax of MAV FKG Kft. In 2012 only one company showed deficit among 25 companies with the largest operating turnover working in the region. Manufacture of structural metal products performed the best by 4,91%

and then electrical, plumbing and other construction installation activities by 4,25% from certain sectors. Manufacture of cement, lime and plaster sector can be highlighted on the negative side due to the reasons which were revealed during the analysis of P/L before tax.

Pre-tax profit margin of construction industrial sectors in certain Hungarian regions in 2012.

Source: c├®ginform├Īcio.hu Kft.

The average number of employees was 186 571 persons in construction industry in 2012, 83% of the sectoral operating turnover are produced by companies employing more than 5 employees, just over 10% of the companies are operating in this segment. Nearly 40% of employees are employed in construction industry, 72 857 persons have been working in the Central Hungarian region. Construction of residential and non-residential constructions and electrical, plumbing and other construction installation activities are standing out from the sectors by 41 078 and 35 486 employees. More than a thousand employees have been employed by only 5 companies: MVM OVIT, M├üV FKG, E-on H├Īl├│zati szolg├Īltat├│ Kft., Johnsons Controls and ELM┼░-├ēM├üSZ h├Īl├│zati szolg├Īltat├│ Kft.

The analysis revealed that Hungarian construction industry has not been able to recover from the shock caused by the crisis, however the development experienced in the profit line suggest that companies rationalized their operations in the recent years and try to accommodate themselves to the changed circumstances. It can be experienced, the increase is already started in case of certain sectors, and those companies who are currently dominant players of the sector were able to further increase their net revenue and profitability.

English

English