Our Data

Analysis of the Hungarian transportation market

The largest transportation companies in Hungary have further increased their operating turnover in 2012. Companies providing complex services were the winners of the market who successfully fought against the growing challenges. Size of the corporations is determinant, as according to the trends more and more the concentration of companies is expected.

The analysis aims to present the processes taking place in the inland forwarding, transportation and logistics market, also the market share and profitability of certain sectors. As the report is based on the financial statements of companies operating in the examined sector, when we talk about market share we mean that operating turnover which consists of domestic and foreign net revenue and other revenues due to the international comparability. Business organizations with double-entry book keeping are included in this analysis, in case of private contractors financial data is not available in the desired level of detail. Determination of sectors has been done according to the NACE classification of main activities where the sub-sectors have been clearly separated. On the basis of this in the Hungarian transportation market the following segments have been the subject of investigation: freight rail transport (492), freight transport by road and removal services (494), transport via pipeline (495), inland freight water transport (504), (512), and other transportation support activities (5229). The transport and logistics service providers are in the latter category but it might happen that a less relevant activity was marked as main activity and for this reason the company got to another category. The analysis does not deal with the transport via pipeline in detail, mainly due to the small number of companies operating in this sector, on the other hand this service is not an option in the field of transportation so it is difficult to compare with the other sectors. The analysis contains international comparison in case of freight rail transport regarding the concentration of the Hungarian market.

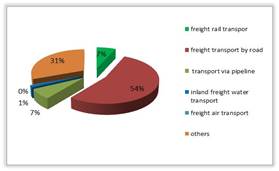

Freight transport by road is the dominant sector in Hungary because of the geographical conditions. The operating revenue was at 1082 billion HUF in 2012 which covered 54% of the total market and exceeded with 100 million HUF the numbers of 2011 and increased with 47% compared to 2008. These of course are nominal values, by counting with real values the picture is more shaded. The service of other transportation support activities (5229) has 31% share, which has reached the 623 billion HUF level of 2012 with a 9 billion increase. Freight rail transport and transport via pipeline also have 7-7%, share of freight air transport is marginal.

Division of operating turnover in transportation sector in Hungary.

Source: Ceginformacio.hu

Freight transport by road

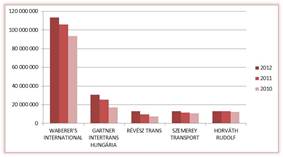

There were 8830 companies in freight transport by road section in 2012, 824 from these employed more than 10 employees. The average number of employees was 48 453 persons in this sector which was 5118 more than in 2008. Less than 10% of the companies which operates in this sector employ more than 10 employees, however nearly 80% of the realized net revenue (793 billion HUF) and 58% of the employees are presented by them. This segment delivered the 100 billion HUF increase that occurred during one year, export net revenue of 242 billion HUF which was performed at sectoral level apart from 6 billion HUF also related to these companies. 10% of the market is represented by Waberer’s International Zrt. with 113 billion HUF operating turnover in 2012 (data comes from the consolidated accounts of the company). 8 from the first 10 companies reached higher net revenue in the last year of the monitored period as before, their total operating turnover was 21 billion HUF more than in the previous year. The biggest growth was performed by Waberer’s and Gartner Intertrans, with 7,5 and 5 billion HUF. The 30 billion operating turnover of the latter in 2012 is more than the triple of the year 2008.

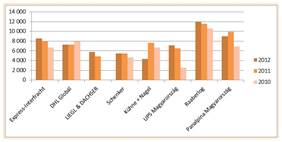

Operating turnover of the biggest road transporting companies in Hungary 2012-2010. Data in thousand HUF.

Source: Ceginformacio.hu

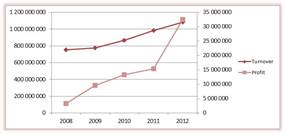

Among the top 10 decrease was only shown by Horváth Rudolf Intertransport and Rapidsped, but could feel themselves compensated for this by the results performed in the profit line which was one of the highest in the past 5 years (1100 and 175 million HUF). In terms of profit the sector showed the best result of the examined period: the performed 32 billion HUF in 2012 is more than double of the previous year and about ten times more than in 2008.

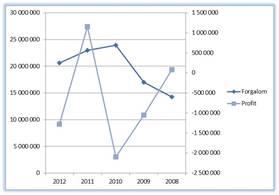

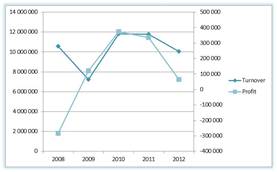

Tendency of operating turnover and P/L before tax 2012-2008. Data in thousand HUF.

Source: Ceginformacio.hu

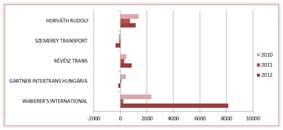

Half of the growth has been delivered by Waberer’s International with 8,1 billion HUF P/L before tax which was higher with 7,9 billion HUF than in 2011. From the companies belonging to the leading group Gartner and Szemerey Transport had negative P/L before tax (-159 and -353 million HUF), which is a result of a 200 million HUF fall compared to the previous year in case of both companies.

P/L before tax of road transporting companies with the largest operating turnover in Hungary 2010-2012. Values are in million HUF.

Source: Ceginformacio.hu

At companies employing more than 10 employees the growth is 13 billion HUF compared to the previous year and 24 billion compared to 2008. Generally we can say the sectoral profit was almost entirely due to this segment 5 years ago, at the same time 18% of the profit (6 billion HUF) has been demanded by those companies which employed 10 or less people in 2012. It is interesting that the loss significantly reduced in the financial P/L line. Due to this the profit of the sector always reduced by around 20 billion HUF earlier, but in 2012 it reduced only by 8,5 billion. The significant negative result was caused by leasing of machines which is typical in this sector, now it is possible the decline of this may be in the background.

Efficiency significantly increased, while in 2008, 18 million HUF got per employee, the income per person was 22,5 million HUF in 2012. Large companies has performed slightly better than the average at Waberer’s Zrt the operating turnover per employee was 27 million HUF, at Gartner Intertrans 21,6 million HUF and at Révész Trans 40 million HUF. DHL Freight and Gefco are standing out in this ratio, both companies have performed values over 100 million HUF in 2012 (141, and 182 million). It is not unique for the latter since it has been performed continuously over 100 million HUF in the past five years and the data of the current year is a result of a constant increase. Companies employing more than 10 employees performed about average (23,3 million HUF), so according to this ratio the larger companies did not prove to be more effective. The mentioned companies outperformed the sector average nearly by 20% at the P/L before tax per employee line. By the examination of the leading group we can find much higher values than the performed 780 000 HUF profit/employee, for example in case of Gefco (5,4 million HUF) or Bogos-Trans (5,6 million HUF). It can be said the ratio has been increasing since 2008, apart from a smaller standstill in the year 2011. The profit margin improved in 2012 (P/L before tax as a percentage of the operating turnover), a 2,98% ratio is nearly the double of the performance of the previous two years (1,56% and 1,54%). According to this J&S Speed, Horváth Rudolf Intertransport and Lerton Trans got on the imaginary winner’s stand (with 9,84, 8,91 and 9,37%-os ratios). Increase can be experienced also at the costs of employees line which at the end of the period was 141 billion HUF at sectoral level, this was 13% of the operating turnover. This is definitely a progress compared to 2008, when 119 billion HUF costs of employees of the sector meant 16% of the income.

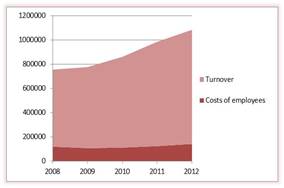

Sectoral operating turnover and costs of employees. Data in million HUF.

Source: Ceginformacio.hu

Also here Gefco, DHL and Bogos-Trans performed best (3,98, 5,14, and 5,09%). Companies employing more than 10 employees performed slightly worse than the average, in the past five years, they accomplished around a stable 15% efficiency. Several of the companies belonging to the leading group have a ratio over 20% for example Gartner (21,46%), Horváth Rudolf (22,65%) or Reining Transport (23,13%). At the same time costs of employees per person is higher than the average at the mentioned companies. By the end of the examined period the sector average has increased from 2,7 million in 2008 to 2,9 million HUF. The highest costs of employees per person was experienced at Terravia Trans (7,8 million HUF), DHL Freight (7,26 million HUF) and Gefco (7,25 million HUF). The latter two finished among the first in almost all profitability ratios, therefore the high amount spent on staff is somewhat surprising. Both return on assets and return on equity (ROA, ROE) also permanently improved at sectoral level over the last 5 years. The 5,29 and 15,87% values of 2012 have been outperformed by companies employing more than 10 employees (6,05 and 18,28%), which is not surprising by knowing that the significant part of the industrial profit is owing to them.Â

The share capital of the sector has increased only by 2 billion HUF compared to 2008, greater progress can be experienced at the shareholders’ funds line, value has increased nominally from 142 billion HUF to 203 billion HUF. In 2012 the share capital per company was 23 million HUF which is 5 million more than 5 years ago. Companies employing more than 10 employees subscribe ¾ (three quarter) of the capital stock and the whole of the previously mentioned growth. All this confirms the earlier assumption that the market is more concentrated towards highly capitalized companies.

Other transportation support activities

In 2012, 1970 companies operated in this sector, the average statistical workforce was 13844 persons. The operating turnover was 623 billion HUF in the current year which is 9 billion more compared to 2011, 182 billion from this is owed to the 10 largest companies. There were no significant reorganization in the leading group, the net revenue realized by them was only 2 billion less than in the previous year.

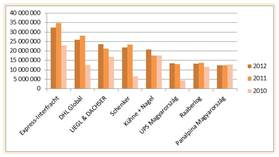

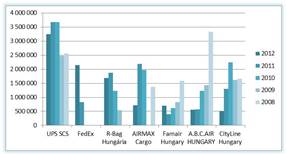

Operating turnover of the largest companies doing other transportation support activities in Hungary 2012-2010. Data in thousand HUF.

Source: Ceginformacio.hu

234 companies employed more than 10 employees, altogether 11134 persons, namely 80% of the people working in the sector. The biggest employer is Syncreon Hungary Kft, employs altogether 1677 people which is 200 employees more compared to 2008. It is followed by KĂĽhne + Nagel and Schenker Nemzetközi SzállĂtmányozási Ă©s Logisztikai Kft, with 433, and 366 persons. The number of employees at both companies hardly exceeded 200 people five years ago. Export net revenue of the sector has shown some growth compared to 2011, 195 billion HUF of the current year is 2% higher than in the previous year. Role of companies employing more than 10 employees is also dominant in this ratio because 88% of the export net revenue of the sector is provided by them. This also occurs in the export share which is 31% with regard to the complete set, but 52% in case of the examined segment. It can be said in both cases, that the ratio constantly increased over the past 5 years. DHL Globál has the largest export net revenue with 25 billion HUF in 2012, which is 96% of the operating turnover of the company. It is followed by Express-Interfracht with 16,8 billion, but here export is not so dominant as in the previous case, it is closer to the industry average rather (51,2%). Liegl & Dachser also had an export net revenue over 10 billion (12,6 billion), which is 31% more than the data three years earlier. P/L before tax of the sector was 17 billion HUF in 2012, which is 2 billion more than in the previous year. From this 7,5 billion HUF occured in the results line of 25 companies with the largest operating turnover, Liegel & Dachser and DHL Globál stand out from them with 1,54 and 1,32 billion HUF P/L before tax. At the latter this is a very sharp change compared to the 1,8 billion HUF loss of 5 years ago, which continuously turned into positive by the constant growth of net revenue.

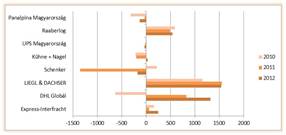

P/L before tax of companies doing other transportation support activities with the largest operating turnover in Hungary in 2010-2012. Values are in million HUF.

Source: Ceginformacio.hu

The profit margin was similar as in the freight transport by road sector, although here has not been a significant displacement compared to the previous year. The 2,7% profit margin of the sector in 2012 is only 0,3 percentage points higher than a year ago, but companies employing more than 10 employees performed weaker than the average in this ratio (2,4% value in 2012). Companies with the largest operating turnover show a varied picture, Petrolsped proved to be the most effective, its P/L before tax was 12% of the annual operating turnover. The two leading companies, Liegl & Dachser and DHL Globál also performed above the average at the profit line with 6,5 and 5,3% ratios. The operating turnover per person is nearly 45 million HUF in the sector, which is surprisingly higher than the aggregated value of companies employing more than 10 employees. In average 41,3 million HUF gets to one employee at companies of the latter segment, at the same time much higher numbers can be found at the largest companies. Such as the previously mentioned Petrolsped’s nearly 1 billion HUF operating turnover per employee (its 4,76 billion HUF net revenue has been performed by 5 employees), or the ratio of Express-Interfracht and Raaberlog exceeding 250 million HUF (277, and 263 million HUF).

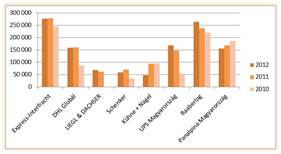

Operating turnover per person of companies with the largest operating turnover 2010-2012. Data in thousand HUF.

Source: Ceginformacio.hu

The situation is the same in case of P/L before tax per person: on sectoral level 1 million 230 thousand HUF profit gets to one person (which is 5 thousand HUF higher than in 2011), however this value is slightly lower at companies employing more than 10 employees (889 thousand HUF). Raaberlog has the highest value from the leading group, 11,67 million P/L before tax gets per an employee. DHL Globál are not too far behind it, with 8,5 million HUF and Liegel & Dachser with 4,5 million. In the middle group we can also meet with outstanding profitable ratios: at the previously mentioned Petrolsped this value is 112,5 million HUF, but 29,4 million HUF gets per an employee at HTNS Hungary, 27 million at Hilltop logisztikai Kft. At sectoral level the costs of employees per person were 3,98 million HUF at the end of the examined period, which is less by 175 thousand HUF than in 2011. The average is higher at companies employing more than 10 employees, the double of this is not exceptional at the limited members of the leading group. The costs of employees per person is nearly 12 million HUF at Raaberlog and Expeditors International Hungary Kft, but Panalpina Magyarország and Express-Interfracht also spend a lot to their employees (9, and 8,6 million HUF/person/year).

Costs of employees per person 2012-2010. Data in thousand HUF.

Source: Ceginformacio.hu

Companies operating in this sector has spent on average 8,8% of the operating turnover on costs of employees, 0,6 percentage points more than a year ago. This ratio is a little bit over of 9% at Gebrüder Weiss, Schenker and Kühne + Nagel, apart from them companies with the largest operationg turnover performed better based on this ratio. In 2012 the return on assets (ROA) was 7% at sectoral level, apart from the recession in 2009 the ratio continuously improves just as the return on equity (ROE), but here stagnation was experienced compared to the previous year (20,4% in 2012). At the end of the examined period the shareholders’ funds of the sector was 83,7 million HUF, this is 13% higher than in 2011, shareholders’ funds per company was 42,5 million HUF.

Inland freight water transport

Freight water transport was given by 130 companies as main activity in 2012, but inland freight water tranport was given only by 35. The sector which is subject to this examination, performed 20,6 billion HUF operating turnover in 2012, 1,36 billion less than in the previous year.Â

Tendency of operating turnover and P/L before tax 2012-2008. Data in thousand HUF.

Source: Ceginformacio.hu

More than half of this, 11,95 billion HUF is subscribed by one company: DDSG MAHART Kft. Due to the high market share the performance of the whole sector is determined by a nearly 4 billion fall in the operating turnover compared to 2011. 3 companies also have a net revenue over 1 billion HUF, Euro-TankhajĂł SzállĂtási, SzállĂtmányozási Kft., Fluvius HajĂłzási Ă©s SzállĂtmányozási Kft. and Interlighter Nemzetközi HajĂłzási Vállalat. 90% of the sectoral operating turnover is subscribed by these four companies. Apart from DDSG MAHART all were able to increase their operating turnover compared to the previous year, but 9,1 billion HUF operating turnover of Euro-TankhajĂł in 2010 came close to the leader’s performance but it suffered 7 billion HUF fall in this ratio in the next year.

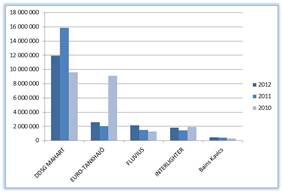

Operating turnover of the largest inland freight water transport companies in Hungary 2012-2010. Data in thousand HUF.

Source: Ceginformacio.hu

Despite the lower operating turnover the sectoral export has increased by 4 billion HUF during a year, and due this the export share has changed from 58% to 88% in 2012. All from the leader companies were able to increase their export revenue, most intensively DDSG MAHART. Nearly 3 billion increase resulted in 34% growth. The sectoral P/L before tax was positive only in 2011, at this time there was 1,16 billion HUF plus in this result line. Only the 2,1 billion deficit in 2010 was worse than the 1,27 billion loss in the current year. Here also the numbers of DDSG MAHART are determinant, since 88% of the total losses occurred at this company. The P/L before tax of another 14 companies were negative in 2012, together with DDSG MAHART they all accumulated 1,6 billion loss. There are 20 companies at the positive side, the best has been TRIREMA Hajózási és Kereskedelmi Kft. ranked at 6th place in the operating turnover-based gradiation with its 85 million HUF result. It is followed by Bains Kavics Kft. and DUNAVY Kft. The result of all three companies significantly improved compared to 2011. The negative P/L before tax has an influence on the efficiency of the sector. The profit margin was -6,22% in 2012, owing to the low ratios of companies which realized operating turnover over 1 billion HUF. Besides the -12% profit margin of DDSG MAHARTB none of the three follower companies exceeded 1%, the profit was only 0,48-0,84% of the operating turnover. The 37% ratio of Sandra Nautica Hajózási Kft. is prominent among the companies, this company has been listed in the register only for two years, quadruplicated its operating turnover compared to last year and its 35 million HUF P/L before tax was the fourth highest in the sector.

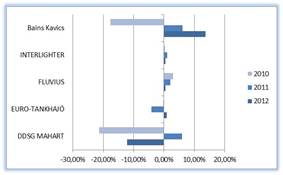

Profit margin of inland freight water transport companies with largest operating turnover 2010-2012.

Source: Ceginformacio.hu

The number of employees was 219 at the end of the examined period, 3 persons less than in 2011. The largest employer is DDSG MAHART with 65 people, which is 48 less than in 2008. Also relatively larger employers are Magyar HajĂłfuvarozĂł Szövetkezet and Jylland HajĂłzási Kft. with 29 and 21 people. Companies typically operate with low number of employees, due to this the operating turnover per person in this sector is quite high, it was 94 million HUF in 2012. Interlighter for example performed its 1,8 billion HUF operating turnover with two people, but among the first four companies all have a ratio over 100 million HUF/person. The costs of employees per person show decreasing tendency, the sector average was 4,46 million HUF in 2010 which decreased to 3,64 million in 2012. Here we have to mention that the costs of employees were 205 million HUF at Euro-TankhajĂł in 2010, and the average number of employees were 8 people therefore it significantly increased the ratio in the given year. The sectoral shareholders’ funds and value of total assets are continuously decreasing, in 2012 the 3 billion and 6,8 billion HUF are entirely reflecting the changes taking place at DDSG MAHART. The shareholders’ funds of the company were nearly -1 billion HUF in the current year which, compared to 12 billion HUF in 2012, is a significant fall, while the asset value decreased from 14,8 billion to 2,2 billion.Â

Freight rail transport

There were 27 active freight rail transport companies in Hungary in 2012, they performed 128,4 billion operating turnover which is 3% lower than in 2011 but we could register a 29 billion HUF increase compared to 2008. The appearance of Ukrailtrans Trade and Logistic Kft. and GYSEV Cargo Zrt. on the market also contributed to this. Although 60% of the sectoral operating turnover was provided by Rail Cargo Zrt. in 2012, its dominance somehow decreased compared to the state five years earlier. The two new companies together produced nearly 30 billion HUF operating turnover at the end of the examined period, thus completed with Rail Cargo, 82% of the entire Hungarian market is represented by them.

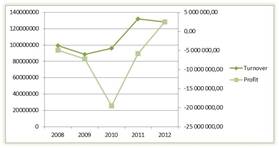

Tendency of operating turnover and P/L before tax 2012-2008. Data in thousand HUF.

Source: Ceginformacio.hu

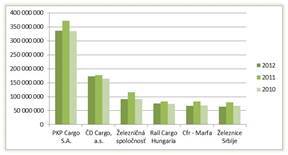

Among regional competitors the Polish PKP Cargo S.A. stands out with its 336 billion operating turnover (calculated in HUF) in the last year. It is followed by the Czech CD Cargo a.s. with 173 billion HUF. Zeleznicna spolocnost Cargo Slovakia, CFR Marfa from Bucharest and Zeleznice Srbije also performed similar operating turnover as the Hungarian Rail Cargo.

Operating turnover of the largest Eastern-European freight rail transportation companies 2012-2010. Data in thousand HUF.

Source: Ceginformacio.hu

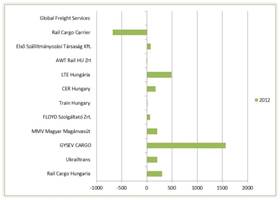

The sectoral export has decreased by 5 billion HUF compared to 2011, however it is still more than double of the 2008 numbers. The increase happened after 2010, then the export of Ukrailtrans grew nearly 15 billion, GYSEV appeared who performed 9,4 billion export revenue at once and also there was 3,3 billion improvement on the export line at Rail Cargo. According to this the export share also increased from 22% to 39% during the examined period. We could record the highest value in 2011, then the export was 42% of the operating turnover. Among the companies the ratio is higher than 90% in case of Ukrailtrans and AWT Rail HU Zrt., but GYSEV Cargo and Floyd szolgáltató Zrt. are also export-oriented. The sectoral P/L before tax was positive for the first time in the past five years, which is not surprising in the light of the fact that the largest companies were all showed a gain in 2012. Rail Cargo similarly to the sector closed the negative series that lasted for years, 7,3 billion HUF loss in 2011 was replaced by 350 million HUF positive P/L before tax which covered the freight rail transportation sector into „green”. The highest result was performed by GYSEV Cargo at the examined ratio, the company continuously generated profit during its operation, at the end of the period its 1,56 billion HUF P/L before tax is the higest among the examined companies in the past five years. LTE Hungária performed similarly, their 488 million HUF result is the highest since the company has started its operation in Hungary in 2009. Major loss was recorded only at one company: Rail Cargo Carrier Kft. The minus 678 million HUF P/L before tax means 95% of the realized loss in the sector.

P/L before tax of freight rail transportation companies with the largest operating turnover in Hungary in 2012. Values are in million HUF.

Source: Ceginformacio.hu

The sectoral profit margin was 1,9% in 2012, LTE Hungária and GYSEV Cargo were significantly differed from this to a positive direction (19,6 and 13,4%). The ratio is highly correlated to the profit numbers of Rail Cargo, which shows an U shape. However, such trend that would show similarity to one of the sectoral ratios cannot be discovered in case of the other companies. The regional leader PKP Cargo has 6,19% ratio, however, other Eastern European companies included in the analysis, significantly underperformed the Hungarian average. The loss of Zeleznice Srbije in 2012 was 44% of its annual operating turnover, the same value at Cfr Marfa was 39%, compared to which both companies have produced worse result in the past 5 years. Return on assets (ROA) was 2,5% in the current year, the ratio did not show as large swings over the years of losses, as it was experienced in case of return of equity. Shareholders’ funds was reduced to half by the 19,5 billion sectoral loss in 2010, due to this ROE was -94%, and the ratio was even lower at two companies: Train Hungary and Rail Cargo (-143, and -124%).

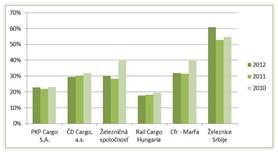

Number of employees in this sector was 3097 people in 2012, which is 211 persons less than in 2008. Rail Cargo was the largest employer, but the number of employees decreased by 24% at the company in the examined period. This was compensated by the presence of GYSEV Cargo and the enlargement of workforce of other leader companies. Changes having taken place in the sector had positive impact on the staff efficiency ratios, as besides the growth of operating turnover and profit, the number of employees decreased. On average the operating turnover per person was 41,4 million HUF, this is higher by 11,4 million than 5 years ago. The 956 million HUF ratio of Ukrailtrans significantly differs from this due to the high operating turnover and the low number of employees (18 people). We can meet values different from the average at other companies, only four companies except the already mentioned Ukrailtrans had a ratio over 100 million. Larger differences can be experienced in case of P/L before tax per person, as Rail Cargo was the only company responsible for the majority of losses in the previous years. Because of, this several companies outperformed the industry average which was 811 thousand HUF in 2012. Ukrailtrans stands out here as well with its 11,9 million ratio, but it is even exceeded by the performance of LTE Hungária (69,8 million/person). Two companies from the leading group have approached the 10 million HUF limit, CER Hungary and GYSEV Cargo (7,8, and 6,9 million/person). During 5 years the costs of employees have increased by 18% at sectoral level, which resulted in significant increase in ratio per person. Consequently, at the end of the period an annual 5,75 million HUF got per an employee compared to the 4,57 million in 2008. Rail Cargo stands closest to the average, expenditures per person are slightly lower at GYSEV Cargo (5,14 million HUF) and at Ukrailtrans (5,29 million HUF). We could register slightly higher values at the follower companies, typically 7 and 10 million HUF costs of employees got per person. Unlike companies dominant in the region, apart from the Czech CD Cargo a.s., where the value is 6,8 million HUF, on average we can see numbers between 2 and 4 million HUF. Generally it can be said that costs of employees appear in the operating turnover of Hungarian companies in lesser proportion. Currently this is 10% at sectoral level, the 17,7% value of Rail Cargo slightly differs upward from this. In regional comparison, this is not considered bad, because this ratio is 22,8% at PKP and we cannot find ratios below 20% at the other competitors either.

Costs of employees expressed in percentage of the operating turnover at the largest Eastern- European companies 2012-2010.

Source: Ceginformacio.hu

This is largely due to the fact that the number of employees of the given companies is significantly higher than at their Hungarian competitors, therefore the volume of investment will be considerably higher, even if less is spent on an employee.

Freight air transport

Freight air transport was given as principal activity altogether by 19 companies, five of them did not have net revenue according to their 2012 financial statements. Operating turnover of the current year was 10 billion HUF, 1,7 billion less than in 2011, and underperformed the 5 years earlier numbers by by 500 million. There were 3 companies with operating turnover over 3 billion HUF, they share 70% of sectoral operating turnover. The 32% share of UPS SCS szállĂtmányozási Kft. rises above the others. Previously Fernair Hungary, A.B.C. Air Hungary, Airmax Cargo and CityLine Hungary also had higher net revenue, but for today their influence on the sector has considerably decreased. Apparently 3 companies benefited from this, FedEx Trade Networks Kft., R-Bag Hungária Kft. and the already mentioned UPS SCS, because the net revenue realized by them practically increased by as much as the turnover of the mentioned 4 companies has reduced.

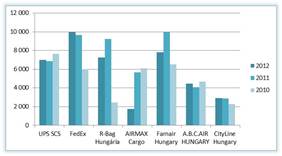

Operating turnover of the largest freight ait transporting companies in Hungary 2012-2010. Data in thousand HUF.

Source: Ceginformacio.hu

The sectoral export net revenue was nearly 700 million HUF more than in the previous year, in 2012 the value was 5,41 billion HUF which is the higest in the past 5 years. In 2011 UPS took over the role of the largest exporter from Cityline, and increased its volume over 2 billion HUF. The sectoral export share increased by 13,7 percentage points within a year and exceeded 50% (53,67%). The ratio is 62 and 70% at the two companies with the largest operating turnover, however the followers, R-Bag Hungária and Airmax Cargo are far not so much export-oriented (0, and 27%). The sectoral P/L before tax was 64,6 million HUF in the current year, which is 81% lower than a year ago, but the 2008 figures are exceeded by 348 million. Positive P/L before tax has been performed by 9 companies, realizing a total of 193 million HUF.

Tendency of operating turnover and P/L before tax 2012-2008. Data in thousand HUF.

Source: Ceginformacio.hu

91,5% of the total volume is provided by four companies. There are 6 companies on the negative side, having accumulated a total of 128 million loss. The sectoral profit margin moved around the typical values of the transportation sector between 2009 and 2011 (1,6-3,1%), but due to simultaneous 218 million HUF profit decrease of HUK Magyar Ukrán Légitársaság Kft and Airmax Cargo, the ratio decreased below 1%, to 0,6%. The average statistical number of employees was 150 persons, 21 persons less than a year ago. Currently the largest employer is UPS SCS with 35 persons, followed by Airmax Cargo and Cityline with 25-25 persons. The sectoral staff cut is mainly due to the latter, a year ago the number of employees were 53 at the company. In the transportation industry the operating turnover per person is the highest in this sector. 67 million HUF got per employee in 2012, which is 1,9 million less than in the previous year, however it is more than 50% higher than in 2009 when there was a low point. With regard to P/L before tax per person the year 2010 was the culminating point: the sector performed the highest profit (375 million HUF) then, and despite the fact that the average headcount was also the highest in the past five years, P/L before tax per person exceeded 2 million HUF. 431 thousand HUF value of the current year is owing to the fact that the dynamics of the profit decline exceeded many times the same ratio of the decrease of headcount.

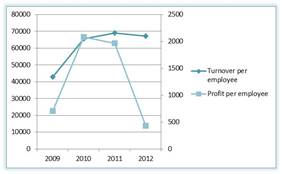

Tendency of sectoral operating turnover and profit per person 2012-2009. Data in thousand HUF.

Source: Ceginformacio.hu

Costs of employees per person were 5,37 million HUF in 2012, 2% more than a year ago, but we could experience a higher value with 1,1 million HUF compared to year 2010. This is currently 8,5% of the net revenue, this means a slight deterioration in terms of profitability compared to the 6,8% two years ago. Generally it can be said that the ratio continuously declined at those companies where the net revenue significantly decreased in the examined period, so the reduction in the working force did not keep up with the decrease of the operating turnover. At companies belonging to the leading group the ratio is between 4,3 and 7,6%, R-Bag Hungária had the lowest value. Costs of employees per person had increased in case of the majority of the companies compared to the years preceding the crisis, the most gets at FedEx per employee this was nearly 10 million in 2012.

Costs of employees per person 2012-2010. Data in thousand HUF.

Source: Ceginformacio.hu

The sectoral return on equity (ROE) has been continuously decreasing since 2010, which can be traced back to the already mentioned profit decrease, because the extent of the sectoral shareholders’ funds practically has not changed over the past 5 years. The 3,29% ratio quotes the 2009 and 2008 years, the overall picture, however, is worse in case of return on assets (ROA), because besides the decrease of the profit the sectoral asset value continuously increased, so this had a negative effect on the profitability ratio from both sides. The 0,4% value of the current year is the lowest in the examined period.  Â

English

English