Our Data

PERFORMANCE OF THE HUNGARIAN CHEMICAL INDUSTRY 2019 (November 2013.)

Written by:Gábor Szücs

The sector has gone through a very difficult time over the past years. Besides recession the industry had to deal with different sectorial taxes and the uncertainty caused by exchange rate fluctuations. It seems the companies accepted the challenge and recovering from the free fall placing themselves gradually on growth path.

According to the classification of European Union only NACE 20 counts as chemical industry. In accordance with the explanation of KSH (Hungarian Central Statistical Office) activities marked by 19, 21 and 22 codes also belong to chemical industry. In the present analysis we took the governing principles of the Union as startingpoint.

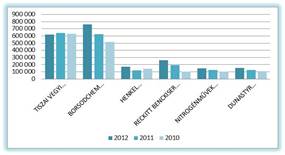

By examining the production of chemical material, product (NACE 20) activities we can establish that besides the growth of turnover in recent years the Hungarian market plays a leading role in the region thanks to the two national giant (TVK, Borsodchem). Because of the 4 billion eur turnover which was realized at the field of production of chemical raw material which means 20% increase to the numbers in 2011 (exchange rate-difference represents half of it) – Hungarian companies make nearly the 50% turnover of the region. From the two largest, TVK was rather stagnant but Borsodchem Zrt. realized a 370 billion revenue increase which was mainly originated from the new market share and opening a TD-2 plant.

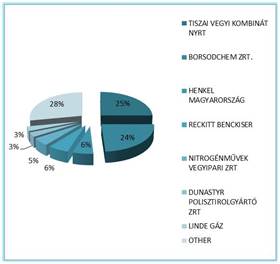

Marketshare of the most relevant Hungarian companies in the chemical industry

Source: Ceginformacio.hu

Examining the markets of the neighbouring countries mainly those companies are dominant in the industry which deal with production of artificial fertilizers and nitrogen-compounds. Such companies are the Slovak Duslo A.S, the Romanian Azomures and the Croatian Petrokemija D.D. It is interesting that the turnover of Rompetrol Petrochemicals which is active in the same sector as TVK was only one sixth, 200 million eur in 2019 compared to the company in Tiszaújváros.

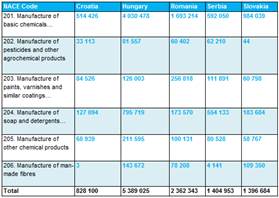

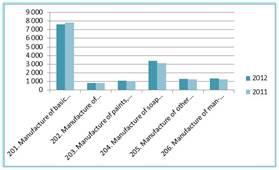

Achievement of chemical industry in different scope of activities in CEE region (data in thousand EUR)

Source: Ceginformacio.hu

Regarding the number of companies there have been 724 such active companies in Hungary in 2019 who identified the activity which is subject of this analysis as their main activity field. Most of them (281 companies) are active in the filed of production of chemical basic material (NACE 201), it is followed by manufacture of cleaning and personal care products with 215 companies then the production of other chemical products with 123 companies.

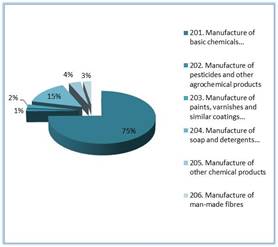

Production of chemical raw material amounts to 75% of the total turnover of the sector, the turnover calculated in eur is 20% higher than in the previous year. Here we have take into consideration when the calculation was made at the end of the year nearly 10% difference was experienced in EUR/HUF exchange rates. Â Taking further apart the areas of activity the production of plastic material (NACE 2016) is the most dominant with its 2,93 billion eur turnover. Â This sector has 54% interest within the production of chemical material and has 75% share within the production of chemical basic material.

Division of different areas of activity according to the turnover

Source: Ceginformacio.hu

The market is highly concentrated, according to the revenue the first ten companies provide 78% of the total sales and all of them except TVK could manage to increase their euro-based revenues compared to the 2011 year. Â Besides the previously mentioned Borsodchem Zrt. it is worth to mention Pannonia Ethanol Zrt. established in 2009, now employing 85 people which revenue has increased with more than 100 million eur.

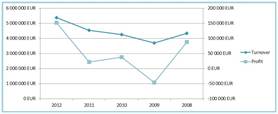

The other sectors also take their part from the growth but most of it arise from the exchange rate deviation. So by counting with the Hungarian currency preferably the stagnation was more typical.  In terms of pre-tax profit the 2009 year meant the low point, by this time the sector produced a negative result of 86 million eur. In this year the turnover decreased by 17% and within it the export by 21%. It shows the power of the sector that this negative trend has been reversed in the following year and the 2010 year was closed with 7 million positive result. At the same time we can experience a positive result at the EBIT row in the last five years, compared to the results of the financial operations which had a result reducing impact and this caused the negative numbers in 2009. The value is still negative until today (-39 million eur), but it decreased to 36% of the 2008 years’ level.

Development of turnover and pre-tax profit  2019-2008

Source: Ceginformacio.hu

The 191 million eur operation profit (EBIT) which was achieved in this year is only 4 million behind the numbers of 2008 but the results of financial operations are improved by 68 million eur at the sectoral level owing to that the profit before taxation is multiple of the 2008 values. It should be noted here the profit figures were significantly modified by the extraordinary result of 346 million achieved by Borsodchem in 2019 whereby it was able to show a pre-tax profit of 271 million eur, thanks to the one time asset takeover to Borsodchem MDI, which was made on market price. Also performed well Nitrogénművek Vegyipari Zrt. and Linde Gáz Zrt. The 77 million eur result of the preceding indicated a 27% profit margin and by completing it with the 37 million pre-tax profit of Linde Gáz Zrt. and 19 million pre-tax profit of Zoltek Vegyipari Zrt. the four companies provide the 70% of the realized profit in the whole sector. According to financial reports of 2019 year positive result was achieved by 422 companies compared to the 374 in 2011. The already mentioned negative result of 63 million eur of TVK is on the negative side (based on the conslolidated report) this means 80% of losses of the sector, the remaining 16 million are shared amongst 216 companies.

Pre-tax profit of Hungarian chemical companies with the largest turnover 2019-2010. Values are in thousand EUR.

Source: Ceginformacio.hu

The section of production of plastic basic material (NACE 2016) is permanently showing a deficit despite the increase in revenues. In 2019 – due to the numbers of extraordinary income line achieved by Borsodchem – positive result was acquired, if we ignore this then the result would be negative. At the same time a 70 million eur increase can be experienced in the profit from ordinary activities line. Half of the companies are profitable the other half is making losses (42 and 43 companies). The section of production of artificial fertilisers and nitrogen compounds (NACE 2015) was more successful. Since the low point in 2009 the pre-tax profit has been continuously increased, the result of 80 billion eur in 2019 is 24% higher than in the previous year. Only five from the examined 23 companies got to the „red” area, realizing a total loss of 30 thousand euros. Also the branch of manufacturing of industrial gas (NACE 2011) has no reason to complain. The pre-tax profit of companies reduced by 12% on the average compared to the previous years but this sector is continuously profitable, the turnover is increased by 14% to 239 million eur in 2019. At the beginning of the crisis, the export revenue was reduced by 21% in the first year but the sector already produced the 2008 numbers by 2010. The realized 2,6 billion eur export revenue in 2019 is 15% higher than in the previous year and 29% higher than in 2008. It is typically an export-oriented sector because the export steadily represents 50% of the revenue.  Borsodchem Zrt. has the largest volume its 763 million eur income means the 29% of the total export.  This was achieved by 20% increase in 2011 and by 22% in 2019. The third biggest exporter, Reckitt Benckiser from Budapest produced similar good numbers which increased its export revenue by 150% compared to 2010 year. TVK realized a 4,3% decrease on the same result line. This was owing to the unfavourable external environment and the maintenance works effected during the year. The volume of production was lower because of great closing down which was only partially compensated by the growing product prices.

Export revenue of Hungarian chemical companies with the largest turnover 2019-2010. Values are in thousand EUR.

Source: Ceginformacio.hu

It is shown here how the market is concentrated, 90% of the sector’s export is given by 11 companies, TVK and Borsodchem provide 52% of it. It is considerable that the 10 companies with the largest turnover except TVK were able to increase their export revenues from 2 billion to 2,35 billion eur.

It is not possible to measure the efficiency with a single index we used the system of those indexes which describe the development and level in a most comprehensive way. The indexes have been calculated by correcting the extraordinary items.

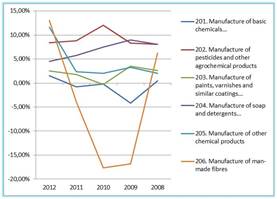

By the investigation of the profit margin we can say that similar to the pre-tax profit – after a smaller standstill in 2011 year – the sector seems to push off the low point. In 2019 the value of 2,82% is 80 percentage points over from the data of 5 years ago. There is no difference in case of the sector of production of chemical basic material (NACE 201) either, the 1,55% positive value put an end to a 3 years negative events. The 2 flagships of the sector do not belong to the leading group because of correcting with the extraordinary result on the basis of the index (-2,41% and -5,86%). The sector of production chemical fiber (206) pictures an interesting curve but here Zoltek Vegyipari Zrt. means more than 80% of the market that is why the numbers of this company dominate here. According to the turnover, the manufacturing of cleaning and personal care products (204) is the second largest sector which has showed a certain decrease in the past 2 years, because the two significant characters Henkel and Reckitt Benckiser are both reported falling margins (5,26 and 3,5% in 2019).

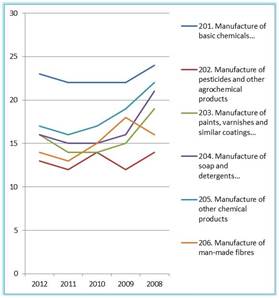

Profit margin of the different field of activities from 2008 till 2019.

Source: Ceginformacio.hu

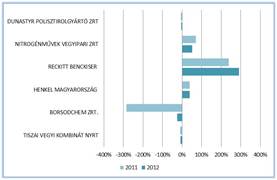

The return on equity (ROE) of the chemical industry has increased from 2,3% of last year to 9,51% based on year / year. According to return on equity Reckitt Benckiser is the most profitable amongst the largest companies, it reached 292% ROE, exceeded the 232% which was made in 2011. It is followed by Nitrogénművek Zrt. with 51,27%. TVK and Borsodchem show improvement while Henkel stagnated compared to 2011 year. Because of the result of Reckitt the cleaning sector highly outperform in this index, though the 36,77% index fell behind the numbers of the previous years, owing to downward trend indexes of Henkel and Colgate-Palmolive.

Return on equity (ROE) of the Hungarian chemical companies with the largest turnover 2019-2011. (Corrigated with extraordinary result)

Source: Ceginformacio.hu

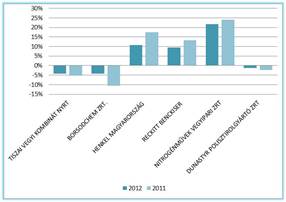

Return on assets has also improved: it has grown from 0,56% in 2011 to 3,23% ROA index at sector level. It was based on the sector with the largest turnover, manufacture of chemical basic material (201) regarding that the index became positive in 2019. Among the leading companies Nitrogénművek Zrt. was the most profitable on return on assets by producing 21% ROA although we observed a slight decrease compared to 2011 year. We can say in general that the index of those who are in the positive range is slightly declined compared to the 2011 year. A reverse trend can be observed amongst those who are in the negative range: ROA is improved in case of all three companies, to the highest degree at Borsodchem Zrt.

Return on assets (ROA) of the Hungarian chemical companies with the largest turnover 2019-2011. (Corrigated with extraordinary result)

Source: Ceginformacio.hu

Staff efficiency and wage conditions

The number of employees in the chemical sector were 15 084 persons average in 2019, which exceeded the previous year’s numbers by 113. The financial indicators projected to one employee mostly show a decreasing tendency.

There are less employees working at the two giants in chemical industry, however, the decrease is not significant, the number of employees at TVK decreased by 19 in annual average while at Borsodchem the biggest employer of the sector the manpower was 170 persons less in 2019 compared to the previous year. This means nearly 7% reduction at the latter. Therefore 143 persons less work in the manufacture of basic chemicals (201) field, however the manpower of Borsodchem MDI Termelő Kft. which producing other chemical materials increased to 120 persons in 2019, that implies rearrangement at the company rather than a real cut-back. At the same time the number increased at the manufacture of cleaning products sector (204) where Henkel and Reckitt Benckiser occupy 44% of the employees, in number 1427 persons. These two companies increased the number of their employees by 104 persons in 2019. On sectoral level growth can be observed too which besides the increase observed at the two before mentioned companies was due to some new arrivals as well. More employees work in the production section of other chemical products (205), paints and coatings (203). The former increased the number of its personnel by 46 persons while the latter by 18 persons. An increase took place in the section of chemical fiber production (206) too, due to the development of staff by 47 persons at Zoltek Vegyipari Zrt.

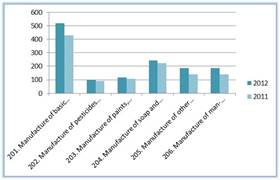

Number of employees in each chemical sectors 2019-2011

Source: Ceginformacio.hu

The turnover per person shows a U shape which reached 344 thousand eur on sectoral level. This is much exceeded by the value of 518 thousand eur experienced in the manufacture of basic chemical materials section (201) which of course is due to the values of the two companies with the largest turnover. (1 200 000 and 507 000 eur).

Turnover per person in each section 2019-2011. Values are in thousand EUR.

Source: Ceginformacio.hu

On sectoral level the costs of employees were 19 thousand eur per person in 2019 that has been practically permanent during the past years. In light of the Hungarian tax conditions this means an annual 9500 eur net wage which is nearly 800 eur per month. With this statement we assume that the whole amount of the expenditure is spent on the payment of wages. Examining the single sectors the highest costs of employees per person are found at those companies which produce basic chemical materials (201) that is 23 thousand eur per year. Borsodchem brings this average value while TVK even overperforms this number by 7 thousand eur. The value of this index is the lowest in the sector of manufacture of agricultural chemical products (202) where significant proportion of companies are operating in disadvantaged regions. In other sections this index varies between 16-17 thousand eur.

Costs of employees per person in the single sectors 2019-2008. Values are in thousand EUR.

Source: Ceginformacio.hu

It can be observed in the past 4 years that companies try to realize their given turnovers by less costs of employees. This fact is confirmed by the continuous decline of the corresponding index (costs of emloyees in % of the turnover). The value changed from 7,64% to 5,43% during the examined period. Unsurprisingly the leading section of manufacturing basic chemical materials (201) proved to be the most efficient according to the above index, as due to the economies of scale giant corporations usually make better use of human resources. Generally saying, the bigger the turnover realized by the given sector, the better values this efficiency index will show. In most cases improvement can be detected during the examination of the single sectors, only the paints and coatings production (203) reached a slightly worse result than in the previous years.

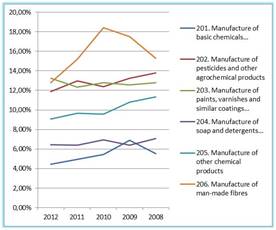

Costs of employees expressed in % of the turnover. Values are in thousand EUR.

Source: Ceginformacio.hu

Althoughturbulent economic environment means a continuous challenge to the sectors, we can say on the basis of the numbers that the positive effects of improved activity and efficiency can be detected in the results. Interesting trends can be found by examining the individual performances: more companies belonging to the leading group which increased successfully their turnovers and reached better result than in the previous years. At the same time the favourable 2019 performance must be dealt with in its place, as due the intense export orientation an accidental foreign lurch could push the whole sector to recession again. Â

English

English