Our Data

Beer manufacturing in Hungary and Carpathian Basin region. 2021

Source: Ceginformacio.hu

Past and present of beer manufacturing in Hungary and Carpathian Basin region

Hungarian beer manufacturing has a century old history, however the investments only really started in the seventies. At that time four large state-owned breweries operated which expanded by Borsodi Sörgyár (Borsodi Brewery) from Eastern Hungary and Komáromi Brewery in the eighties. Then it was not possible to hear about small factories because beer manufacturing was considered as the duty of the state.  Locations have not, the names less but the owners totally changed not only in Hungary but in the whole region.

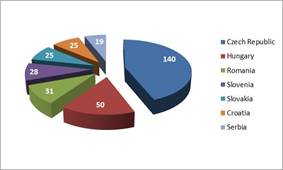

The analysis focused on the financial side of the sector, where the group of the examined companies was determined according to the related NACE code (1105 manufacture of beer). Regarding the international comparison, turnover ratio also contains the other revenues besides net sales revenues and certain profitable ratios were calculated by adjusting exceptional items. Considering the number of companies surprisingly Hungary is ahead of Romania which is due to the spread of smaller distilleries. Currently in Hungary there are about 50 companies engaged in beer manufacturing and 31 firms at our eastern neighbour. Not surprisingly Czech Republic is the number one by 140 companies, the number of breweries is between 20-30 in the other countries.

Number of companies operating in beer manufacturing in Hungary and neighbouring countries.

Source: Ceginformacio.hu

According to net sales revenues Heineken Magyarország Sörgyárak (Heineken Breweries in Hungary) took the first place in the domestic market in 2021. The company operates two factories, one in Sopron and the other one in Martfű. The owner is Brau-Union AG from Austria, who merged with Heineken at the beginning of last decade, so the Dutch owned brewery in Komárom was closed. Besides the Hungarian subsidiary the multinational beer company has several interests in the region Karlovacka Pivovara in Croatia, Heineken Ceska Republika A.S., Heineken Slovensko A.S. or Heineken Romania SRL.

Dreher Sörgyárak Zrt. is owned by SABMILLER Europe BV (South African Breweries) which also has several other interest in the neighbouring countries, for example Slovakian Pivovary Topovar A.S., Czech Plzensky Prazdoj, Romanian Ursus Breweries AS.

Borsodi is owned by Molson Coors Brewing Company from Denver, after Starbev was bought by it in June 2021. Through its subsidiaries it is also a major player of the region’s beer industry. According to net revenue Serbian Apatinska Pivara longs to the front, it is followed by the Croatian Zagrebacka Pivivara D.o.o., the already mentioned Borsodi Sörgyár Kft, and then the Romanian Bergenbier SA close the line. The brewery in Pécs is owned by Ottakringer Getränke AG from Austria.

The largest breweries of the region according to their net revenue in 2021. Data in thousand HUF.

Source: Ceginformacio.hu

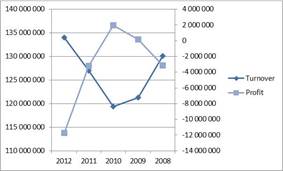

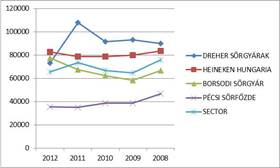

In terms of net revenue a smaller decline was experienced in the sector after 2008, which can be explained by the outbreak of the economic crisis. At the beginning of the examined period 130 billion HUF net revenue was realized by Hungarian beer manufacturing at sectoral level. The law point came in 2010, when decrease was nearly 9% compared to the value of two years ago. 134 billion HUF in the current year is higher than the numbers before the crisis, however in real terms we cannot talk about progress. At regional level Hungary is preceded by Czech Republic and Romania in terms of realized net revenue, the performance of the sector was nearly 1 billion EUR and 750 million EUR in both countries in 2021.

Tendency of operating turnover and P/L after tax of Hungarian beer manufacturing sector. 2021-2008. Data in thousand HUF.

Source: Ceginformacio.hu

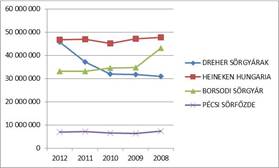

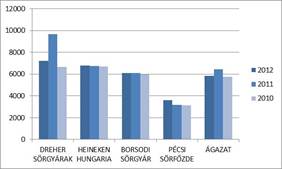

In Hungary Dreher Sörgyárak Zrt. is the obvious winner of the period, 45,8 billion HUF net revenue of the company in 2021 is 50% higher than at the beginning of the period, the largest increase performed between 2010 - 2011 and 2011 - 2021. At this time its annual net revenue was increased by 5,2 billion HUF then 8,6 billion HUF. In case of Heineken we cannot speak about greater volatility, net revenue of the company steadily moved around 47 billion HUF. Borsodi Sörgyár was affected more sensitively by the crisis, the examined ratio decreased by 8,3 billion HUF in 2009, since then the annual net revenue moves around 33 and 34 billion HUF. The factory in Pécs is slightly behind the three large companies, 7 billion HUF net revenue of the current year an order of magnitude lower than the leading companies have, after that only smaller factories can be found in the market, whose target group is entirely different from the leading companies. These breweries mostly locally sell their product or for pubs, which are typically not very full-bodied ales but more expensively produced peculiar ales. Among them Ko-Cse Serföződő Kft. from Ecser can be considered as the most significant by 158 million HUF net revenue. Previously Ilzer Italgyártó Zrt from Monor had more influence, its 600 million HUF net revenue decreased to 1,3 million HUF for today. The market is highly concentrated towards the large factories, 99,1% of the Hungarian market are provided by them.

Tendency of operating turnover of the leading beer manufacturing companies in Hungary. 2021-2008. Data in thousand HUF.

Source: Ceginformacio.hu

Source: ceginformacio.hu Hungary

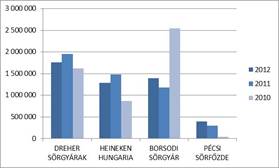

Export net revenue and also export share show a constant decrease at sectoral level. In 2008 export amounted to 5,7% of net sales revenues which decreased by 3,6% in 2021. In terms of volume the fall is similar: the sectoral export declined from 7,4 billion HUF to 4,8 billion HUF. By examining certain companies, the change is immediately apparent resulting in the export net revenue of Borsodi Sörgyár which shows 3,1 billion HUF difference towards negative direction compared to data of 5 years earlier.

Tendency of export net revenue of the leading beer manufacturing companies in Hungary. 2021-2010. Data in thousand HUF.

Source: Ceginformacio.hu

After that Dreher Sörgyárak is considered the largest exporter in the sector today, which has a more significant decline in 2009 (export net revenue reduced to about half), but apart from that year the realized income on the given result line is balanced. In this respect PĂ©csi SörfĹ‘zde took the biggest step, previously negligible export volume became 400 million HUF by 2021. Smaller factories did not have export net revenue during the examined period, which supports the previous conclusion, they temporarily orientate themselves to domestic market only.Â

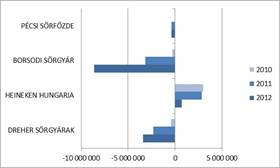

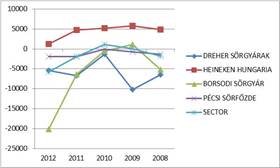

2021 was a bad year for the sector from the point of view of P/L before tax, 11,7 billion HUF loss is the weakest data in the examined period and the decline is not negligible compared to the net revenue. Apart from Heineken we have to look for those years with magnifying glass when leading companies have stayed in positive range, Dreher, Pécsi Sörfőzde and Borsodi are continuously showing a deficit, for the latter -8,6 billion HUF P/L before tax mainly due to 19 billion HUF other expenditures, which was significantly higher than in the previous years. Heineken also underperformed the usual value of around 3 billion HUF but remains in the positive range further on. Profit making ability of smaller companies is interesting, because in their case there is no an owner with considerable means at the background who could provide life-line if necessary and their survival may depend on the examined result line. Surprisingly the picture was not so bad for what we should infer from the performance of leading companies: 28 companies performed positive P/L before tax and 22 companies got to the negative side.

P/L before tax of the leading beer manufacturing companies in Hungary. 2021-2010. Data in thousand HUF.

Source: Ceginformacio.hu

Profitable ratios of the sector

If is not possible to measure the efficiency with a single index we used the system of those indexes which describe the development and level of the sector in a most comprehensive way.

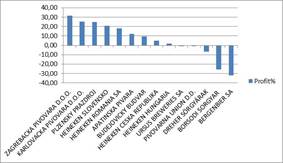

Profit margin is a measure of P/L before tax as a percentage of net sales revenues which is one of the most commonly used indicator to measure profitability. According to this beer manufacturers in Hungary do not exactly live their best time, ratio is -8,76% at sectoral level, which is similarly to P/L before tax is the lowest result of the examined period. The ratio was positive in 2009 and 2010, profit margin was 0,11% and 1,65%. With the exception of Heineken the profit margin was negative in case of all large companies, sectoral decline is explained by -26% ratio of Borsodi Sörgyár. In regional comparison we get a rather mixed picture, however the picture is less gloomy than in case of Hungary. Apart from the Romanian Bergenbier SA (the ratio is -32,6% here) we typically see values between 0 and 25%. The 25,7% profit margin of Czech Plzensky Prazdoj A.S. in the current year should be pointed out, but the profitability of the third largest Heineken Romania SA (18,3%) and Croatian Zagrebacka Pivovara (33,2%) are also remarkable at regional level.

Leading breweries of the region according to their profit as a proportion of sales revenue. Data in %.

Source: Ceginformacio.hu

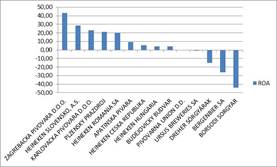

Assets of the sector have decreased by 18% during 5 years to 68,8 billion HUF due to changes occurred in the assets of the 3 leading companies. The most significant decrease was at Borsodi Sörgyár with more than 9 billion HUF, but Heineken also had 5 million HUF more assets in 2008 than at the end of the current year. Considering the negative tendency experienced at the profit line we could not expect much good from the sectoral return on assets (ROA), which was worsened further by the already mentioned change at the total assets line. Among the leading companies the ratio is positive only at Heineken because the 3,6% ratio of the current year is far behind from the values above 10% of the previous years. ROA was -44% at Borsodi in the year 2021, mainly due to its P/L before tax. At Dreher the movement of the ratio was also influenced by the accounted loss at the result line, volatility of the assets was negligible. Around 20% return on assets is not uncommon at the other determinant breweries of the region, the 43,3% ratio of Zagrebacka Pivovara stands out among the top companies.

Leading breweries of the region according to their return on assets. Data in % .

Source: Ceginformacio.hu

Losses accounted by the players having main influence of the sector also occur at the shareholder’s equity line, which is therefore constantly decreasing. At the beginning of the period the ratio was 32,2 billion HUF at sectoral level, which permanently declined to 5,2 billion HUF value during the examined period. This process is unindirectional typically at each larger players, shareholder’s equity is unchanged at Heineken Hungária only, because the profit is continuously removed in the form of dividends. In the year 2009 it was raised with a further 7,2 billion HUF at the expense of accumulated profit reserve that is why there was a more spectacular decrease at the shareholder’s equity line in the given year. In some places negative P/L before tax is combined with negative shareholders’ equity, so in this case we could hardly draw appropriate conclusions from ROE (return on equity) ratio. At sectoral level the ratio was -227,6% in 2021, it moved around 8 and -16% in the previous years. We can experience just the opposite in case of the neighbouring breweries, where in some cases we can meet values above 50% . Here we can see Plzensky Prazdoj with 59,7% ratio, but this value has been surpassed by Zagrebacka Pivovara and Heineken Slovensko: they performed 90 and 108% return on equity in 2021.

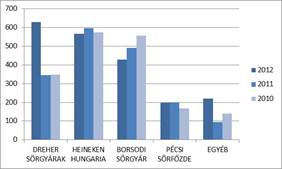

Staff and earnings ratios

Number of employees of the sector significantly increased in 2021 compared to the data of the previous year, which is mainly due to growth of workforce by 283 persons at Dreher Sörgyárak. Smaller and larger fluctuations were observed during the previous years, 2039 employees in the current year obviously means the culminating point of the examined period. This is 16% higher than the data of five years ago and 15% higher than a year ago. The already mentioned Dreher Sörgyárak is the largest employer of the sector, it is followed by Heineken with 565 persons, then followed by Borsodi and Pécsi Sörgyár with 428 and 197 employees. 89% of the employees are employed by one of the four dominant players, smaller companies are typically operate with less than 10 people, some of them are found directly behind the leading companies who exceed this level.

The average statistical number of employees of the leading beer manufacturing companies in Hungary. 2021-2010.

Source: Ceginformacio.hu

Compared to conditions in Hungary the sectoral costs of employees per person is high. 5,8 million HUF in the current year practically the same as value in 2008, but 10% lower than the data of the previous year. According to the ratio Dreher Sörgyárak somewhat rise above the field, the registered 9,6 million HUF costs of employees per person in 2011 already have approached the level of telecommunications sector. Heineken and Borsodi are next with 6,8 and 6,1 million HUF. The 700 thousand HUF margin is a good example for the difference between the two regions regarding the payment conditions. Pécsi Sörház spends an order of magnitude less for its workers, the 3,6 million HUF in the current year is higher by 450 thousand HUF than in the previous year and we can find only lower numbers in the previous years. Costs of employees of smaller companies are below what we have experienced at the leading companies, typically less than 2 million HUF get to an employee per year.

Costs of employees per person of the leading beer manufacturing companies in Hungary. 2021-2010. Data in thousand HUF.

Source: Ceginformacio.hu

Significant increase in 2021 also occurred in the average statistical number of employees and in net revenue per person, certainly the profitble ratio has been worsen by it because a more modest growth at sectoral net revenue line was made. So the performed 65,7 million HUF can be compared to the level of the years 2009 and 2010, fallback is above 10% compared to the ratio of the beginning of the period and a year earlier. The largest decline can be experienced at Dreher Sörgyárak, where we can search for the causes in the already mentioned increase of number of employees. In the previous years the sectoral average was outperformed by the company, net revenue per person was above 90 million HUF. In the current year Heineken Hungária became the first by 82,7 million HUF ratio, and it only obtained better performance in 2008. It is followed by Borsodi with 5 million HUF less where 2021 year’s ratio is the highest in the examined period. Profitability is much lower at smaller manufacturers, in most cases net revenue per person does not exceed 10 million HUF either.

Operating turnover per person of the sector and leading beer manufacturing companies in Hungary 2021-2008.

Source: Ceginformacio.hu

The picture is more shaded in case of profit per person, because sectoral loss has an effect on the profitable ratio. 5,8 million HUF loss got per an employee in 2021, which is also the lowest point in the past 5 years as well. Among the large companies the ratio is only positive at Heineken, although 1,2 million HUF in the current year is also the lowest value here. In terms of minuses Borsodi Sörgyár is the leader, more than 20 million HUF loss got per an employee there. At Dreher the same ratio is -5,4 million HUF, while the situation is slightly better in Pécs, the loss is „only” 1,9 million HUF per an employee.

P/L before tax per person of the sector and leading beer manufacturing companies in Hungary 2021-2008. Data in thousand HUF.

Source: Ceginformacio.hu

Beer manufacturing in Hungary was characterized by significant decrease besides stagnant net revenue, which cannot be considered as a general phenomenon in the region, as we find plenty of counter-examples across the border. Due to the stable ownership structure the operation is probably not in danger, but it is uncertain which will be the dominant direction in the forthcoming years. The role of small firms remains marginal, in terms of their survival it will be crucial how the consumer preference changes and ability to pay for special beers. Â

English

English