Our Data

AUTOMOTIVE INDUSTRY IN HUNGARY 2014

Prepared by: G├Ībor Sz├╝cs

In Hungary vehicle manufacturing is henceforward a key sector of processing industry, besides it is getting closer to Slovakia in the regional competition with whom has continuous contention in the acquisition of new capacities. The sector experienced difficult times during the economic crisis, but for today the regional vehicle manufacturing became one of the most prosperous activity.

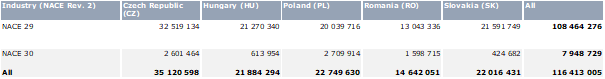

In the definition of the sector we took the main activity codes into consideration, which were in this case 29 (Manufacture of motor vehicles) and 30 codes (Manufacture of other transport equipment). According to the realized net revenue in 2014 by operating companies in this sector Czech Republic is the leader, the 35 billion euro performance makes clear its regional leading role, Slovak Republic is the second, whom Hungarian sector is only left behind by 150 million euro with its 21,9 billion performance. The fourth place is taken by Romania with 14,6 billion euro.

Net revenue of vehicle manufacturing sectors in 2014 in the examined region. Data in 1000 EUR.

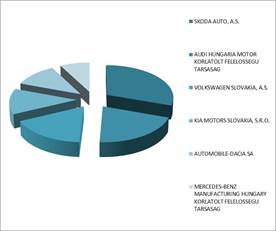

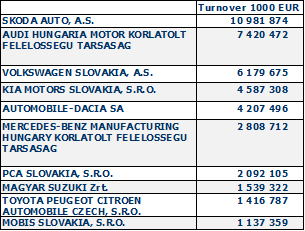

Slovaks have the dominant role among the 10 companies with the largest net revenue, four companies are represented themselves on this exclusive list. Not surprisingly Czech Skoda Auto A.S. has the leading role which has nearly 11 billion euro net revenue in the current year, this is 1,8 billion higher than the data of the previous year. We experienced a nominal increase in case of Audi Hung├Īria, the Hungarian subsidiary of the manufacturer from Ingolstadt became second on the list due to its performance in 2014. The 7,4 billion net revenue is 30% more than two years earlier, the changeover with Slovak Volkswagen is largely due to the stagnation of the factory in Bratislava where net revenue of the current year is almost the same as two years earlier, 6,18 billion euro. KIA motors from Teplicka is in the fourth place, it is closely followed by the Romanian Autmobile Dacia S.A. Performance improvement of the manufacturer from Bucharest is even more imposing than Hungarian Audi, net revenue increased by 50% during two years and reached 4,2 billion euro by 2014. Mercedes factory from Hungary, Suzuki from Esztergom also got to the top 10 list and PCA and Mobis from Slovakia, Toyota, Peugeot, Citroen Automobile Czech S.R.O. from Czech Republic are represented themselves too.

Net revenue of the 10 largest companies operating in the regional vehicle manufacturing sector in 2014. Data in 1000 EUR.

┬Ā

┬Ā

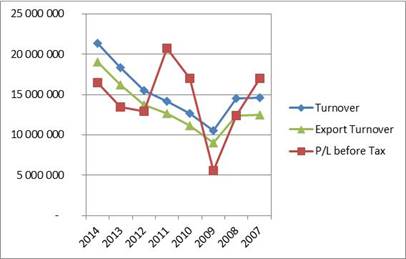

The decisive role of Hungarian vehicle manufacturing in national economy is unquestionable. Net revenue of the sector was 21,4 billion euro by 2014, which is 3 billion more than in the previous year and has doubled compared to the year 2009 considered as the nadir. In the time series of net revenue a linear trend has been observed since 2010 which almost increased at the same rate all along. The motivation of this was the expansion of flagship companies, 9 from 10 companies with the largest net revenue were able to outperform the performance of the previous year, only Suzuki fell behind by 1,5% from the value in 2013. Main part of the previously mentioned 3 billion euro increase can be connected to Audi, exactly 1,56 billion euro. The 800 million increase of Mercedes is also remarkable, because this meant nearly 40% growth, but almost all companies realized around 10% expansion among the first 10.

Tendency of net revenue, export net revenue and P/L before tax in Hungarian vehicle manufacturing. Data in 1000 EUR.

![]()

In the light of this does not mean much surprise the concentration of the sector on the basis of net revenue, 72% of the overall market are owned by the 10 largest companies, 90% consist of net revenue of 36 companies. The 3 major manufacturers have a total of 54,9% market share (acording to net revenue). We have to look for Hungarian owned firms by magnifying class among the first 30 companies, we can meet with the first one at 21st place, R├üBA J├Īrm┼▒ipari Holding occupies this position, further back with a few places, Videoton Autoelektronika is the next at 25th place. In the Czech sector Skoda is similarly dominant, like Audi in Hungary, market share is 33,4% based on net revenue. However 52% of the whole net revenue are given by the 10 largest companies, performance of 92 companies were necessary to 90%, the concentration here is slightly smaller than in Hungarian market. Concentration of Slovak sector is silmilar to the Hungarians, Romanian market is located somewhere between Czech and Hungarian in terms of concentration. Dacia has 30% share, together with Ford and Autoliv they reach 40%. Net revenue of 63 companies is necessary to 90%.

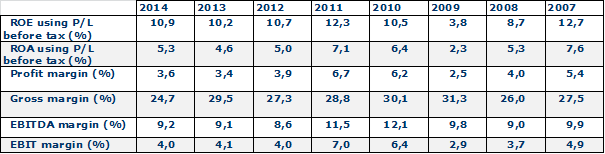

Picture is more shaded in terms of profit, although the industry is still profitable, culminating point of P/L before tax was in 2011, then the actualization of AudiŌĆÖs clearing price system led to a greater reduction, however it has not been possible to reach the local maximum since then. But companies are typically profitable, at the same time regarding the profit margin we do not really meet with outstanding upwards values. Profitability is 3,62% at sectoral level (P/L before tax as a proportion of sales revenue), there was a lower value from this only in 2009. Audi and Mercedes also show a declining profitability over the past 3 years, the previous performed 4,26 and the latter 1,98% profit margin in the current year. Among the leaders the 10th SMR Automotive and the 13th Valeo perfomed higher profitability than 10%, exactly 15,3 and 16,6 %.

Some main important profitable ratios of Hungarian vehicle manufacturing industry. Data in %.

In regional comparison Slovak KIA has the highest value of the examined ratio, 7,91%, it is followed by Czech Skoda by 7%. The other firms produced worse values than Hungarian Audi, but it should be noted none of them were unprofitable in the past 3 years.

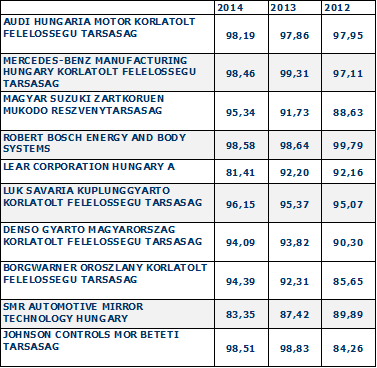

It was evident in the previous years, the sector mainly produces to foreign markets, this is clearly shown by export share ratio, which exceeded 90% again after the year 2013 and performed 90,52% the highest value of the examined period. It is interesting, among 684 companies submitting annual reports only 150 have value at export net revenue line. Export orientation is even more typical among large companies, values above 98% are not rare. Such like Audi, Mercedes or Robert Bosch, it is not possible to find export share which is lower than 80% among the first 15 companies.

Export share ratio of the 10 largest companies in Hungarian vehicle manufacturing. Data in %.

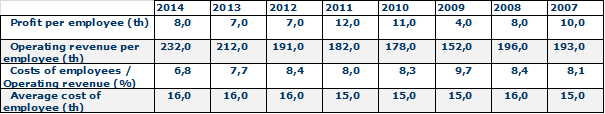

The number of employees continued to increase, 94 000 people worked in Hungarian manufacturing sector in 2014, 5 300 more than a year before. Data of the year 2009 is really striking, when 72 200 persons have been employed by the sector, compared to this the difference is more than 31 000 people. Audi is the largest employer with 11 628 persons, it is followed by Mercedes and Lear Corporation with 3893 and 3757 people. In case of Lear the number of employees has been stagnated in the past 3 years, the two major manufacturers are constantly improving, the difference is 2000 and 1000 persons compared to the year 2012. The sectoral workforce efficiency somehow shows a mixed picture, net revenue per person continuously increasing, however in case of profit does not reach the level of 2011. Costs of employees per person remained unchanged in recent years, it was typically between 15 and 16 thousand euro. Owing to this and continuously increasing net revenue the ratio of costs of employees / operating revenue constantly declining. So for the production of operating revenue unit permanently less costs of employees must be used, this ratio was 6,81% in the curent year, 9,65% in 2009.

Some important staff efficiency ratios of Hungarian vehicle manufacturing sector.

English

English