Our Data

- Home

- Articles

-

Position of telecommunications sector in Hungary in 2020

Hungarian telecommunications market has gone through significant development since the political transformation. It was difficult for state-owned service companies which were in monopolistic position earlier to adapt themselves to the ever increasing customer demands. Capital inflow has started by the privatization to this area and the market competition intensified between the old and new players. Outbreak of the crisis and the various sector taxes put a stop to further growth which is definitely noticeable at the ratios of the sector.

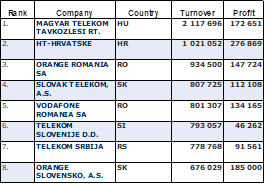

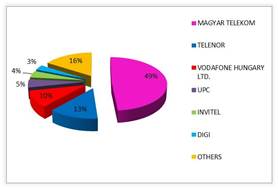

Hungarian telecommunications market can not be considered homogeneous because the size of the players and spectrum of services. There are 1180 active companies among the registered enterprises which gave telecommunications (NACE: 61) as their main activity. The 3 largest mobile phone companies rise above the others, Magyar Telecom, Telenor and Vodafone which represent 70% of the market according to operating turnover. According to this ratio Magyar Telecom is the market leader in Central European region because its net revenue is more than the double of the Croatian HT-Hrvatske Telekomunikacije D.D. It should be noted here the mentioned company is also the subsidiary of Deutsche Telecom as Slovak Telekom A.S. from the fourth place. Orange Romania has inserted among the magenta trio, it has 934 million eur turnover which meant the third place to the company. It is interesting that Telekom Slovenije and Telekom Srbija are not related  to a large foreign giant either, in both cases the state is the owner. Romtelecom the Romanian subsidiary of Deutsche Telecom was just left out from the 8 largest companies. The net revenue of the subject declined by 5,4% to 619,6 million eur in 2020. Regarding the result after tax the Croatian company performed the best, it has 276,9 million eur result which is nearly 100 million eur more than the result of Magyar Telekom.

Turnover and P/L before tax of the largest regional telecommunication companies in 2020. Data in thousand EUR.

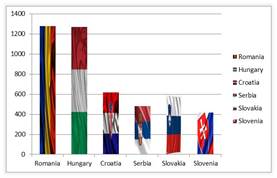

Source: Ceginformacio.huCompanies operating in this sector have the largest operating turnover in Romania, 1278 billion HUF were realized by them in 2020, this was 11 billion eur more than companies operating in Hungarian telecommunications. The leading group is followed by Croatia and Slovakia by operating turnover adequate to 619 and 592 billion HUF. Â

Comparison of the size of telecommunication market in Carpathian Basin countries. Data in billion HUF.

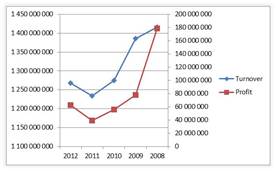

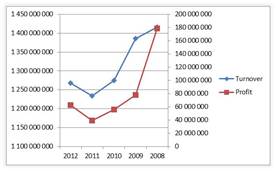

Source: Ceginformacio.huStagnation characterizes the sector according to the key financial ratios. The sectoral operating turnover has not changed in the past 3 years, in 2020 the turnover was 1267 billion HUF which is less by 7 billion HUF compared to 2010 and 34 billion HUF more than the previous year’s data. A significant 10,5% fall can be experienced compared to 2008. The examination of the trend can give reason for optimism, in the last year it occurred for the first time during the examined period the net revenue of the current year exceeded the previous year’s. Only DIGI Távközlési és Szolgáltató Kft. were able to perform higher net revenue in 2020 than in 2008 from the 6 largest market players. The owner of the company is the Romanian RCS & RDS SA, what has subsidiaries besides Hungary in Czech Republic, Serbia, Spain and Slovakia. UPC and Invitel can be found among the 6 companies with the largest operating turnover except the 3 large mobile phone companies. The operating turnover of Invitel has decreased by 37% during 5 years, this can be explained partly by the growth of DIGI, because the two service companies have almost the same target group.

Market share of companies operating in telecommunication according to net revenue in Hungary.

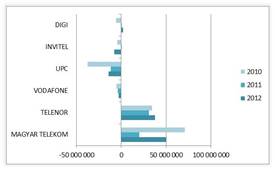

Source: Ceginformacio.huUPC has 62,5 billion HUF operating turnover in the current year which is 11% lower as 5 years ago. Nominally the operating turnover of Magyar Telekom declined to the highest degree by 60 billion HUF compared to 2008, at the same time similarly to the sector curve the downward trend seems to break in 2020. The operating turnover of the other two service companies Telenor and Vodafone was uniformly less by 2 billion HUF in the current year than a year ago.  The highest nominal increase was performed by the already mentioned Magyar Telekom with 13 billion HUF, followed by  Rubicom Telecommunication Kft by 4,7 billion HUF and they are followed by two companies with around 3 billion HUF increase, Business Telecom and DIGI (3,1billion and 3 billion HUF).

Tendency of operating turnover and P/L before tax of Hungarian telecommunication sector 2020-2008. Data in thousand HUF.

Source: Ceginformacio.huOn the negative side the already mentioned negative ratio of Telenor and Vodafone goes to the top of the list. Hungarian telecommunication sector is quite concentrated, 49% of the operating turnover is related to Magyar Telekom, 72,5% of the market is jointly provided by the 3 large mobile phone companies. If we add the net revenue of UPC, Invitel and DIGI to this and they already performed 85%.  Â

Tendency of operating turnover and P/L before tax of Hungarian telecommunication sector 2020-2008. Data in thousand HUF.

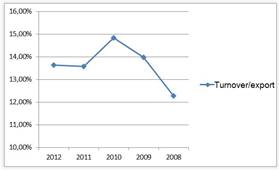

Source: Ceginformacio.huDue to the nature of service, the weight of export is considered marginal. The export ratio is typically around 13-14%, Magyar Telekom has the most significant export net revenue, followed by Ericsson Magyarország Kommunikációs Rendszerek Kft.  30 billion HUF from the 37 billion HUF net revenue of the company is originated from the export activity. The export net revenue of Telenor by 2,5 billion HUF and Vodafone by 5,6 billion HUF is only fraction of 102 billion HUF which was performed by Magyar Telekom.

Export net revenue expressed in percentage of the operating turnover, 2020-2008.

Source: Ceginformacio.huThe sectoral P/L before tax and P/L for period write down a similar path as the operating turnover. Continuous decrease can be experienced from 2008 until 2011 and the trend is broken in the current year. The 2010 numbers are also outperformed by the sectoral P/L before tax in 2020. However still have to make up, despite the positive signs, the performed 178 billion HUF in 2008 is more than the triple of the values of the current year. The 30 billion HUF improvement of Magyar Telekom played a major role in the 62% increase which took place within a year in the examined result line.

P/L before tax of the largest Hungarian telecommunication companies, 2020-2010. Data in thousand HUF.

Source: Ceginformacio.huIn 2020 the profit was 50 billion HUF, which is 52% of the 2008 year’s value. Telenor was able to improve, although its net revenue significantly lower than the leader’s, but its 37,7 billion HUF P/L before tax is close to Telecom’s numbers. Vodafone had suffered losses in the past 3 years, as well as UPC what has 14 billion HUF negative P/L before tax in the current year, this is the lowest at sectoral level.  Profit over 1 billion HUF was performed by Rubicom (2,2 billion), Nokia Solutions (1,2 billion) and DIGI (1,8 billion). Positive P/L before tax was performed by 605 companies, a total of 100 billion HUF. There are 340 companies on the negative side and they realized a loss of 37 billion HUF. 37% of this can be connected to UPC and together with another 5 companies we get 91% of the sectoral loss.

Profitable Ratios of the Sector

It is not possible to measure the efficiency with a single index we used the system of those indexes which< describe the development and level in a most comprehensive way. The indexes have been calculated by correcting the exceptional items.

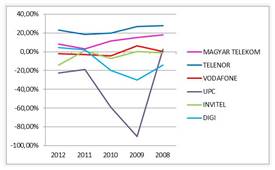

The sectoral profit margin was 4,92% in 2020, 1,76 percentage points higher than in the previous year and significantly lower than the 12,61% from 2008. By the examination of certain companies the 23% ratio of Telenor is remarkable which is more than the triple of 8% value of Magyar Telekom. The smallest difference between the two companies was in 2010, at this time the difference was 8,5 percentage points. Rubicom TávközközlĂ©si Zrt was the most efficient according to the ratio. After 4 years of losses, there was a positive result in 2020 which meant 28,4% profit margin to the company. The ratios of Nokia Solutions and Networks (28%) and the cable tv service provider Tarr ÉpĂtĹ‘ SzolgáltatĂł Ă©s Kereskedelmi Kft. (13,6%) are above the average.

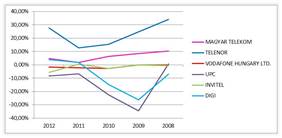

Profit margin of Hungarian telecommunication companies with largest operating turnover, 2020-2008.

Source: Ceginformacio.huUPC and Invitel significantly underperformed the sectoral average in terms of efficiency from companies with the largest operating turnover, both produced negative values (-22,7% and      -14,7%), former was the rearguard of the sector in every year. For example it had 73 billion HUF operating turnover in 2009 and suffered losses of 66 billion HUF which resulted in a -90% ratio. This mainly due to the loans which were taken out by the company. At the same time the long term liabilities of 161,7 billion HUF in 2008 has reduced to 105 billion HUF by 2020. Generally it can be said the low point of the sector was in 2011, after the operating tunover and profit, one of the most important profitable ratio for this year also worst performed. Â

Assets of the sector decreased by 10% compared to 2008 and P/L before tax went through significantly higher decrease, that is why the fluctuation of return on assets (ROA) can be rather compared to the change of profit figures.  In the past 3 years 3,16% was the highest value in 2020 and only 0,37 percentage point below the 2009 year’s ratio. Telenor performed the best from the leading companies, it has 27,8% ratio in the current year which is not too far from the highest value performed in the examined period. Magyar Telekom and DIGI performed near the sectoral average (4,76 and 4,04%), Vodafone, Invitel and UPC moved in negative range.

Return on assets (ROA) of telecommunication companies with the largest operating turnover in Hungary 2020-2008. (Corrigated with extraordinary result)

Source: Ceginformacio.huSectoral shareholders’ funds were the highest in 2010, since then it has about a 10% decline. Value of 2020 year is below about 66 billion HUF of 2008 numbers. This was maninly caused by the reduction in the balance sheet lines of Magyar Telekom, because the shareholders’ funds of the company has decreased by nearly 68 billion HUF during two years. This is due to the dividend policy of the company, they have tried to maintain 50 HUF per share level for many years. This has not been covered in whole by the P/L after tax in 2011 and 2020, therefore had to utilize accumulated profit reserve. It was not any different at Telenor, shareholders’ funds of the company reduced to about one third to 62 billion HUF from the year 2010 to 2011. Here the significant decrease of capital was also due to dividend payment, however slightly increased payments were made at Telenor: they paid 150 billion HUF dividend in 2011 for what 124 billion HUF were used from accumulated profit reserve. The sectoral return on equity due to the significant profit fall is below the 2008 levels, but because of the previously mentioned capital decreases we can not experience such large swings in the ratio as in the P/L before tax line. In the past 3 years 7,14% was the highest value in 2020 and only 1 percentage point below 2009 year’s ratio. Telenor performed the best from the leading companies, it has 61% which is the highest value in the examined period, this is partly due to the significant capital decrease in 2011, secondly to the increasing profit numbers of the past 3 years. Magyar Telekom and DIGI performed near the sectoral average  (10,9 and 5,9%), Vodafone, Invitel and UPC moved in negative range. In case of the last two companies the loss was 35% and 43% of the shareholders’ funds.

Staff and earnings ratios

Regarding this sector we have exact number of employees data since 2009, based on this information we can say a little bit more people worked in Hungarian telecommunication than a year ago. The average headcount was 23 772 persons at the end of the examined period which exceeded the previous year’s data by 2354 persons.

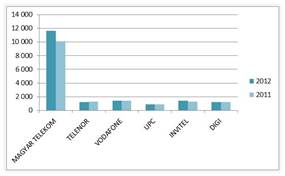

Average headcount of Hungarian telecommunication companies with the largest operating turnover, 2020-2011.

Source: Ceginformacio.huMagyar Telekom is the largest employer of the sector by 11 653 persons, where nearly 10% staff increase took place during a year. The number of employees reduced by 54 persons at Telenor and by 26 persons at Vodafone, however 14% more people worked for the latter than in 2009. 62% of people working in this sector are employed by the 3 large mobile phone companies, even if we add the number of employees of UPC, Invitel, DIGI and  Ericsson Magyarország then we receive 82% working in this sector. Â

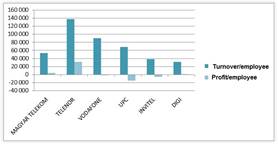

The Operating revenue/employee decreased constantly in the last 4 years, the 53,3 million HUF/capita of the current year is lower with 8 million than in 2009. Considering the main players, the numbers of Magyar Telecom are the most similar to the sectoral average, however the to other mobile provider significantly outperforms it. At Telenor the examined ratio is around 137 million HUF/capita, at Vodafone it was 90 million at the end of the period. At the latter company it is a result of a 17% decrease comparing to data of 4 years before which is being explained by decrease in the Operating revenue and the increase of the number of employees. At UPC there are no significant changes, at Invitel the ratio is constantly decreasing, during the last 4 years from 56,2 million HUF to 38,2 million. On the contrary at DIGI a constant progression can be observed both in the Operating revenue/employee and in the P/L/employee.

Operating turnover per person and profit per person at telecommunication companies with the largest operating turnover in Hungary in 2020. Data in thousand HUF.

Source: Ceginformacio.huThe latter ratio was 2,6 million HUF/capita, higher than in the previous two years. Like in case of the Operating revenue/employee ratio Telenor is on the top of the podium with 31 million HUF/employee. The numbers of Telekom are considerably lower than the leader Telenor, in 2020 they reached only 4,3 million/capita which is less than a half of the 9,1 million from 4 years before. At Vodafone, UPC and Invitel only the loss could be divided, according to this the -15 million of UPC is in the first place however it is significantly better than the -65,7 million/capita at the beginning of the period. Although the numbers of DIGI do not reach the sectoral average (1,4 million/capita), the data form the current year is a result of a steady growth.

The sectoral cost of employee/capita was 7,6 million HUF which is well above to the Hungarian standards, especially when we consider that these numbers nearly reached the 8 million HUF in 2010 and 2011. Magyar Telekom a little bit overperformed the average with its 8 million HUF average costs of employees which was 9 million one year before and 9,4 in 2009. Telenor and Vodafone spend more for their employees, the average is 9,7 and 9,8 million HUF. At UPC and Invitel the ratio is below the average (7,5 and 7,4 million HUF), at DIGI the 4,7 million remains under these numbers.

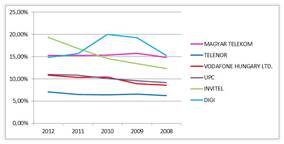

One of the most important ratio is the costs of employees/Operating revenue since it indicates how much do we have to spend for human resources in order to reach the Operating revenue. Obviously the lower is the ratio the more effective can the industry be considered. In case of the Hungarian Telecommunication industry this ratio was 14,2% in 2020 and constantly growing in the last 5 years, so from this aspect the efficiency worsened. We have to highlight Telenor, since it could hold the ratio around 6-7%. Vodafone reached 10,8%, followed by Magyar Telekom with 15,8% in the current year. The ratio worsened significantly at Invitel, since in 2008 it was close to the sectoral average than at the end of the period the costs of employees was 19,3% of the Operating revenue. The numbers of UPC are similar to Vodafone while DIGI is closer to the sectoral average except the last two years.

Costs of employees expressed in percentage of the operating turnover. Values are in percentages.

Source: Ceginformacio.huGenerally speaking the companies are trying to offset the decrease in revenue by the rationalization of their operation. Although we have a very mixed picture regarding the performance of the industry, it is evident that 2020 can be a year of a trend reversal. But it has to be confirmed by the forthcoming years.

English

English